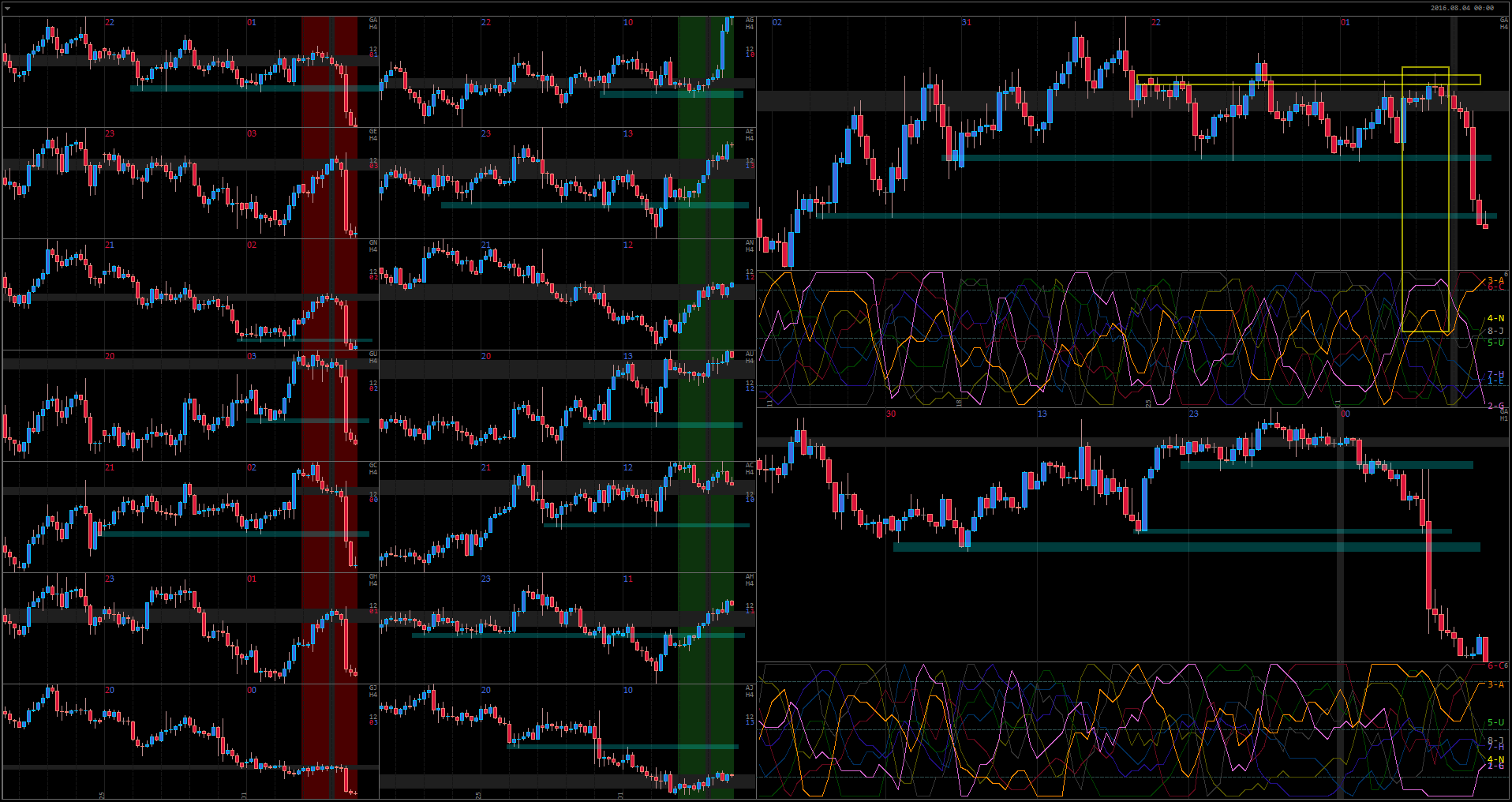

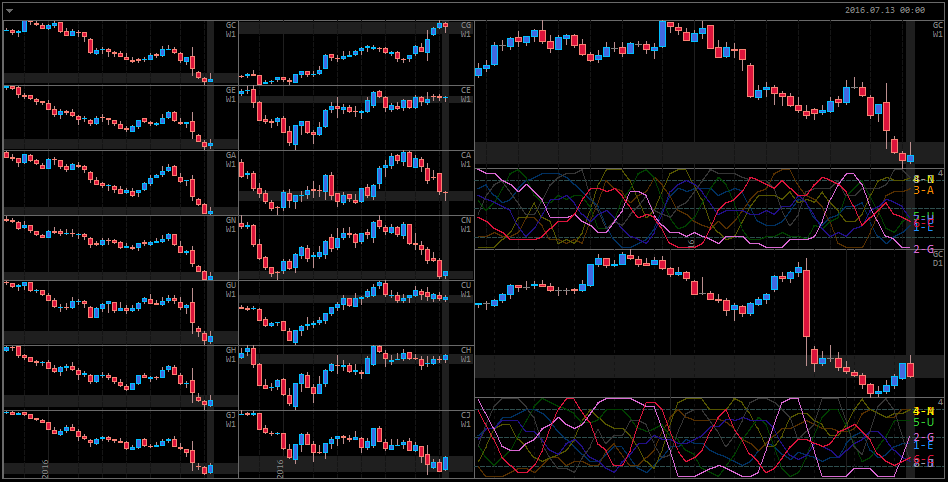

The market has been stagnant on higher timeframes for a long time right now. After the Brexit and before US election the money is hesitating to move.

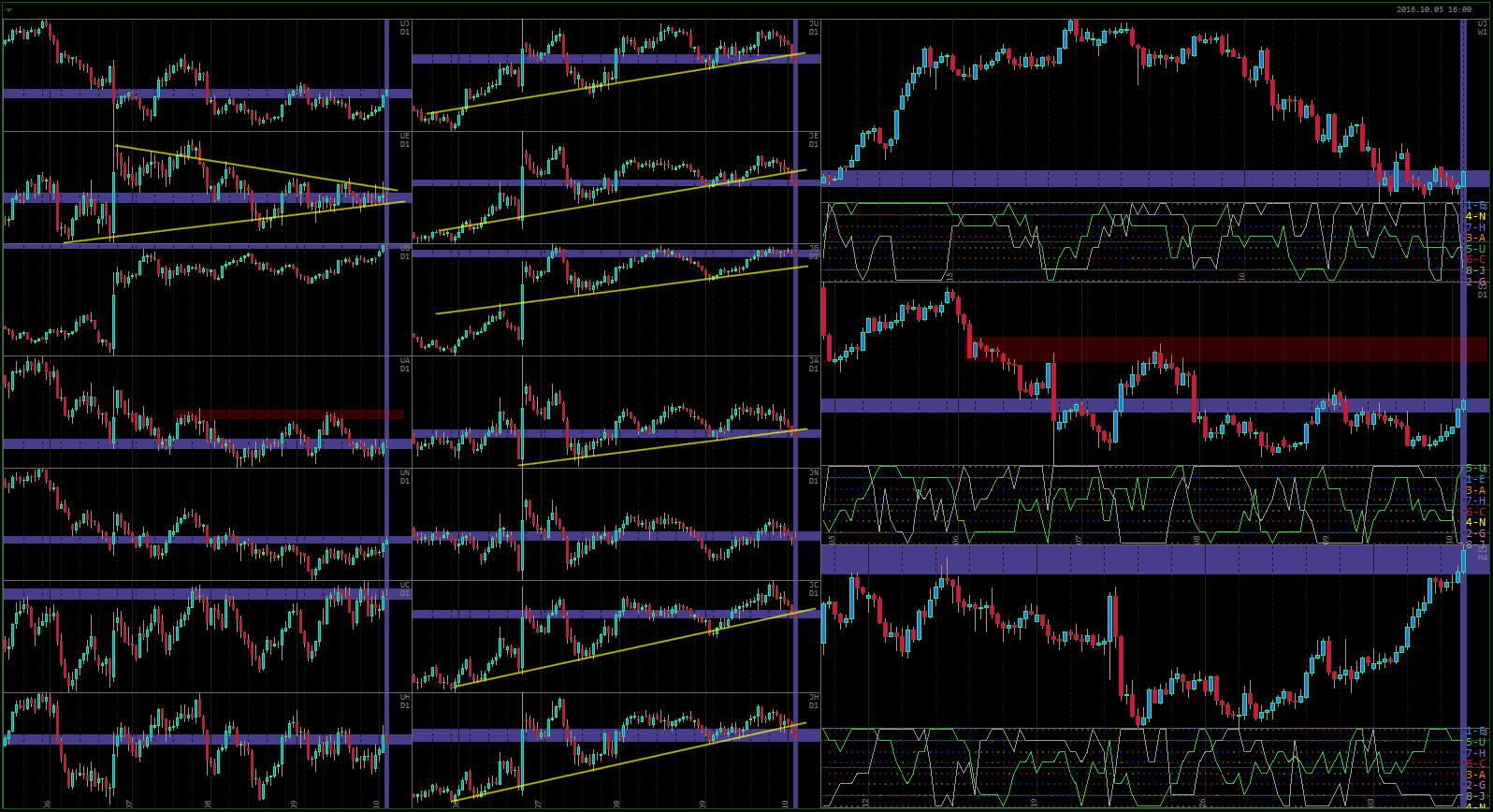

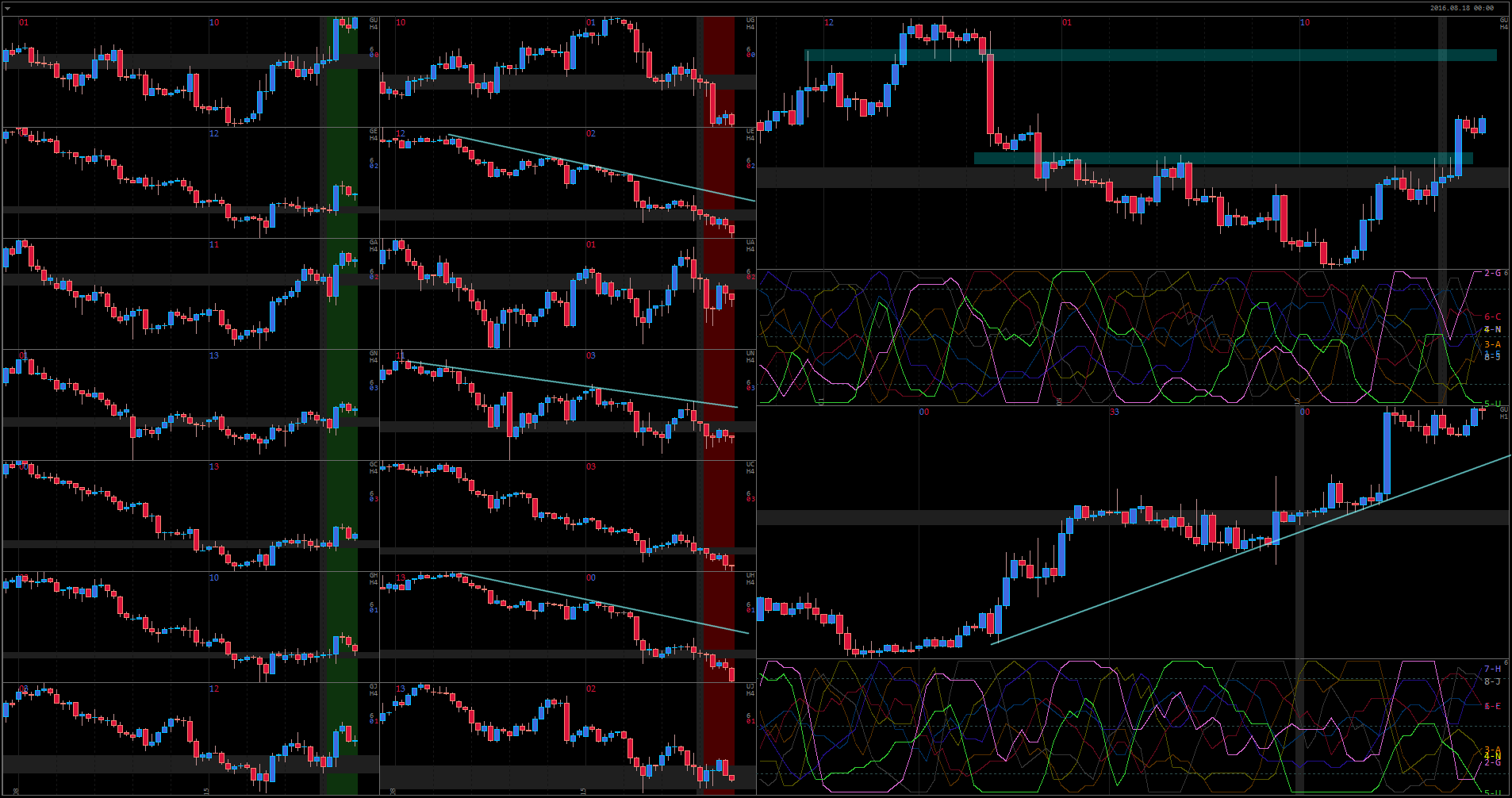

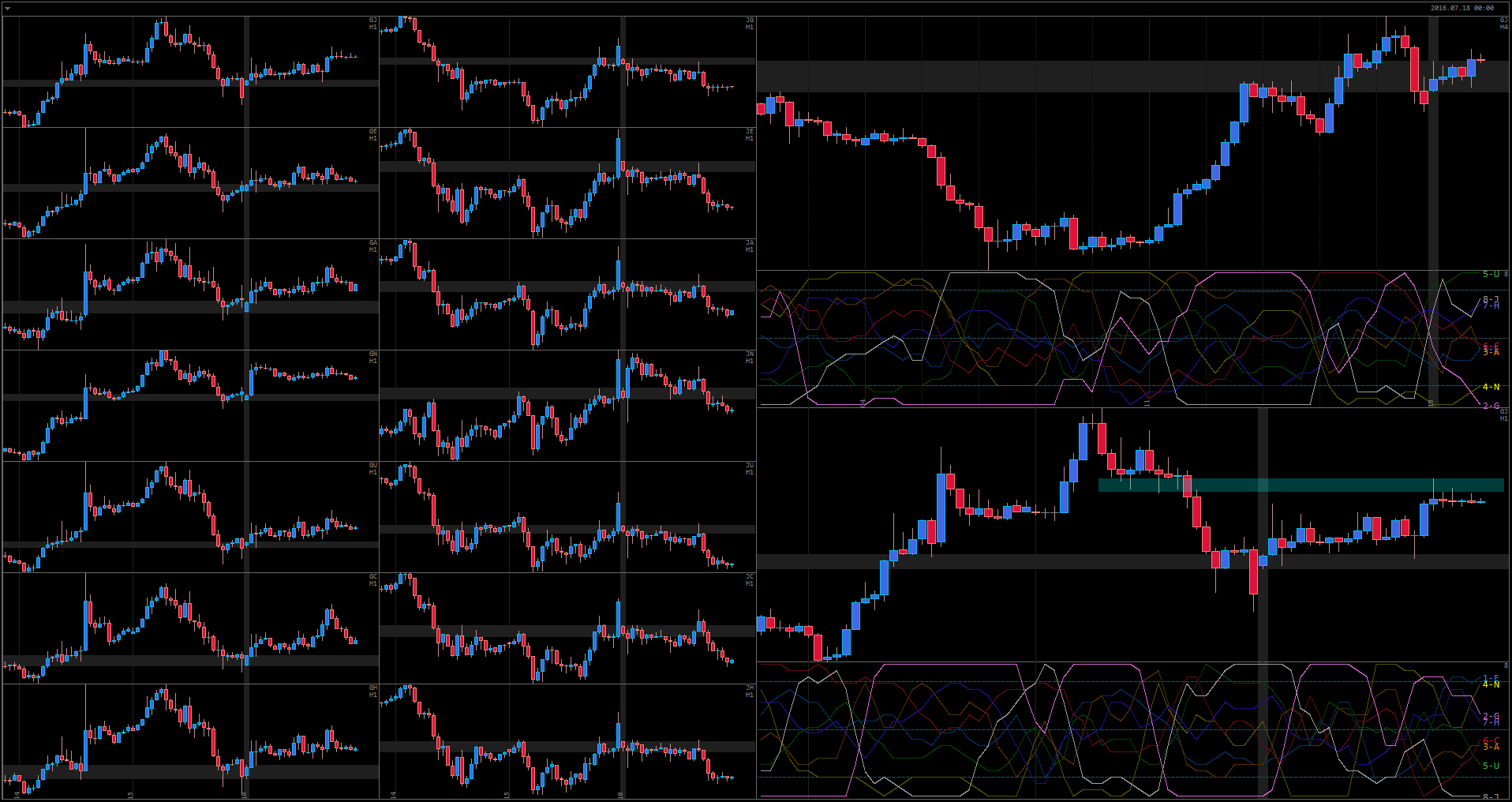

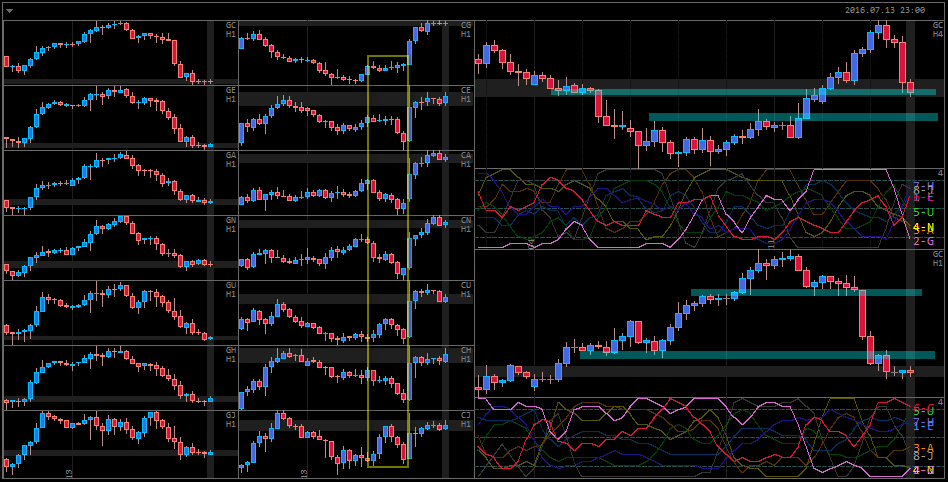

UJ continues moving in the same range for the fourth month. USD looks like a complete mess on daily, with most pairs showing very choppy price action. JPY has been creating some cycles, notably with increasing bearish strength.

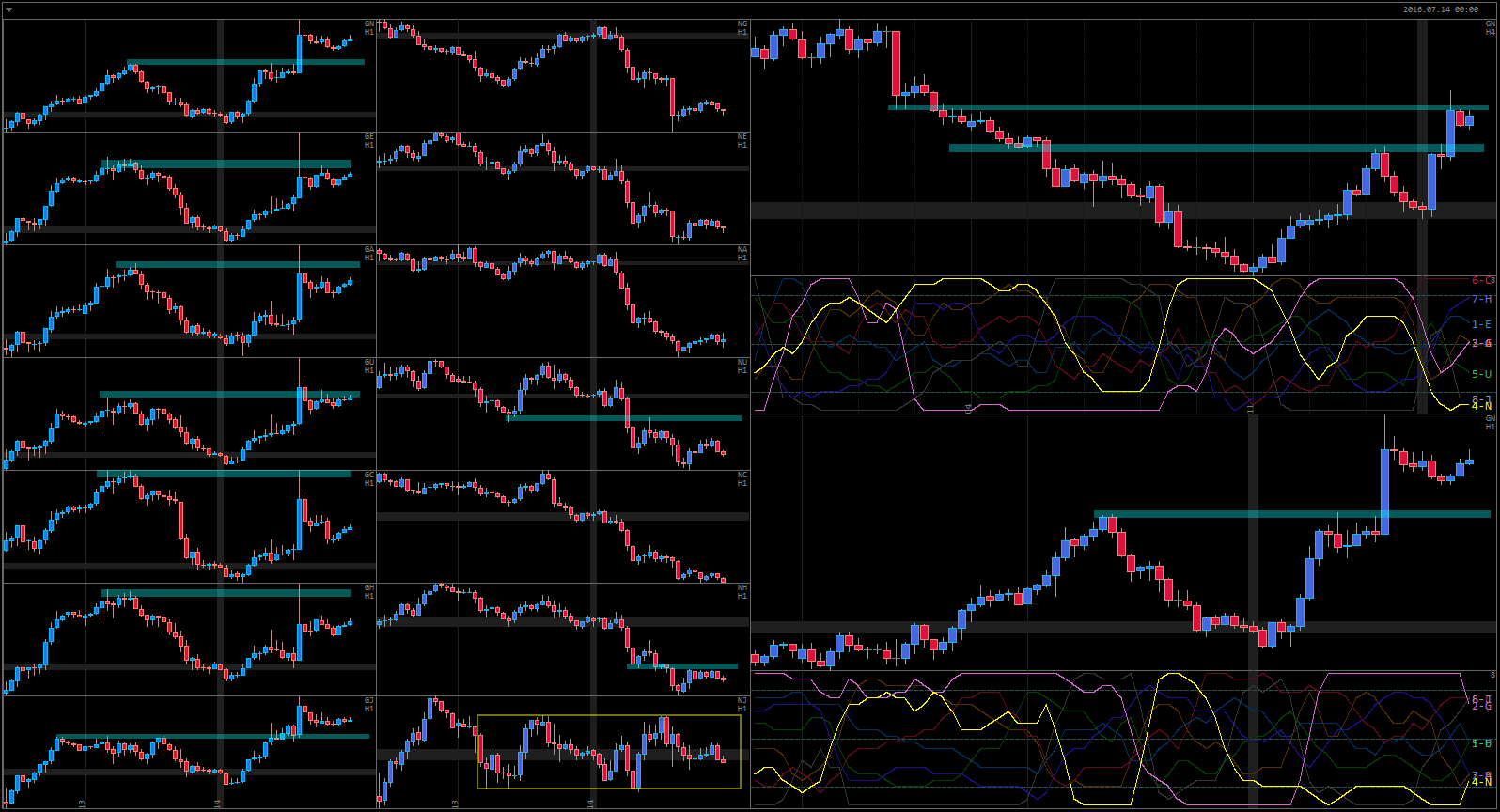

How much higher can JPY go without a significant correction? If the last 3 months has restored the balance on the Market and if JPY is unable to descend soon, the bullish cycle will continue with some significant strength. Notably, most JPY pairs are breaking their Daily trendlines right now. Notably also is that no JPY pairs (other than GJ – barely) have managed to break their Brexit highs.

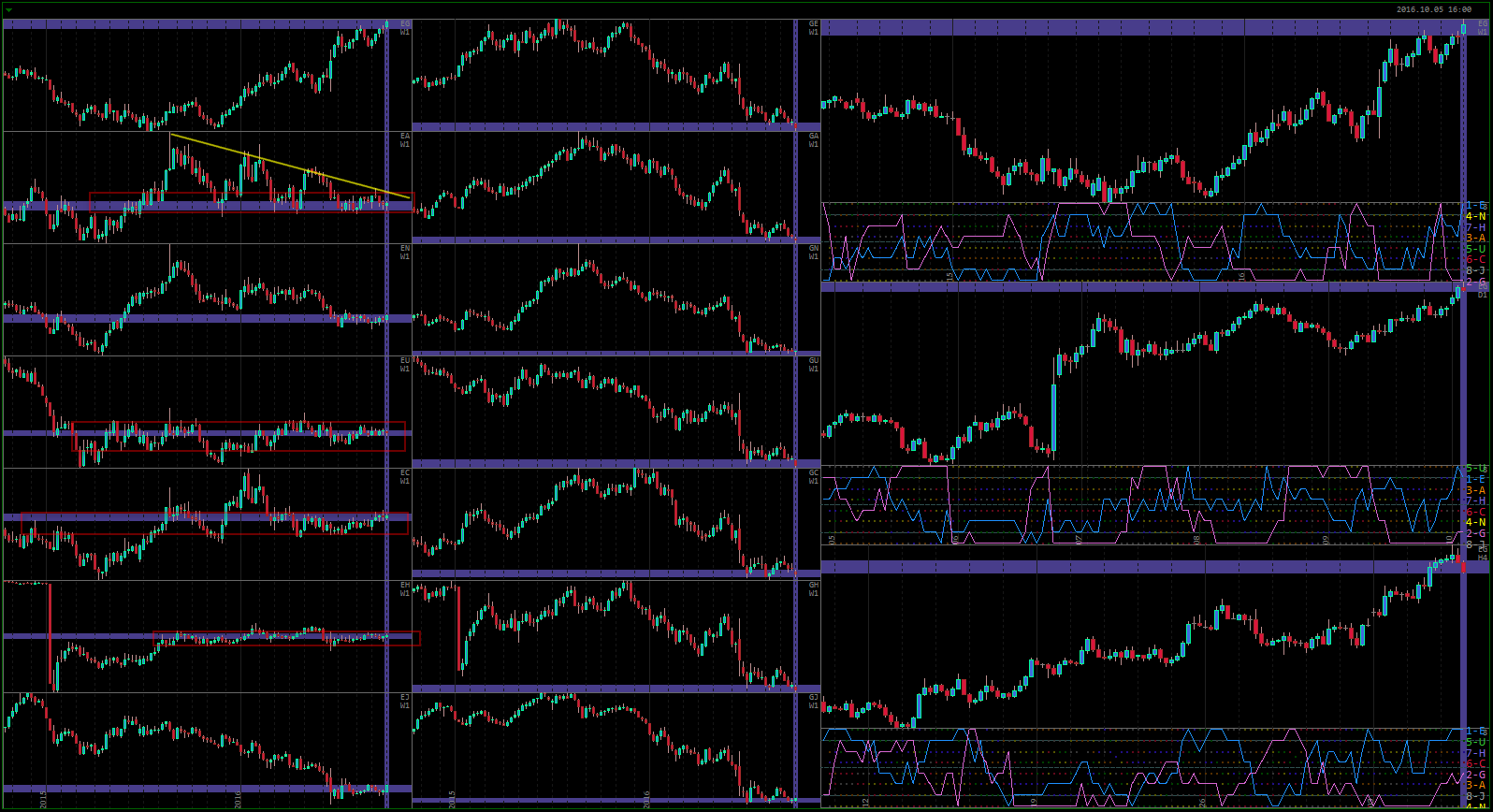

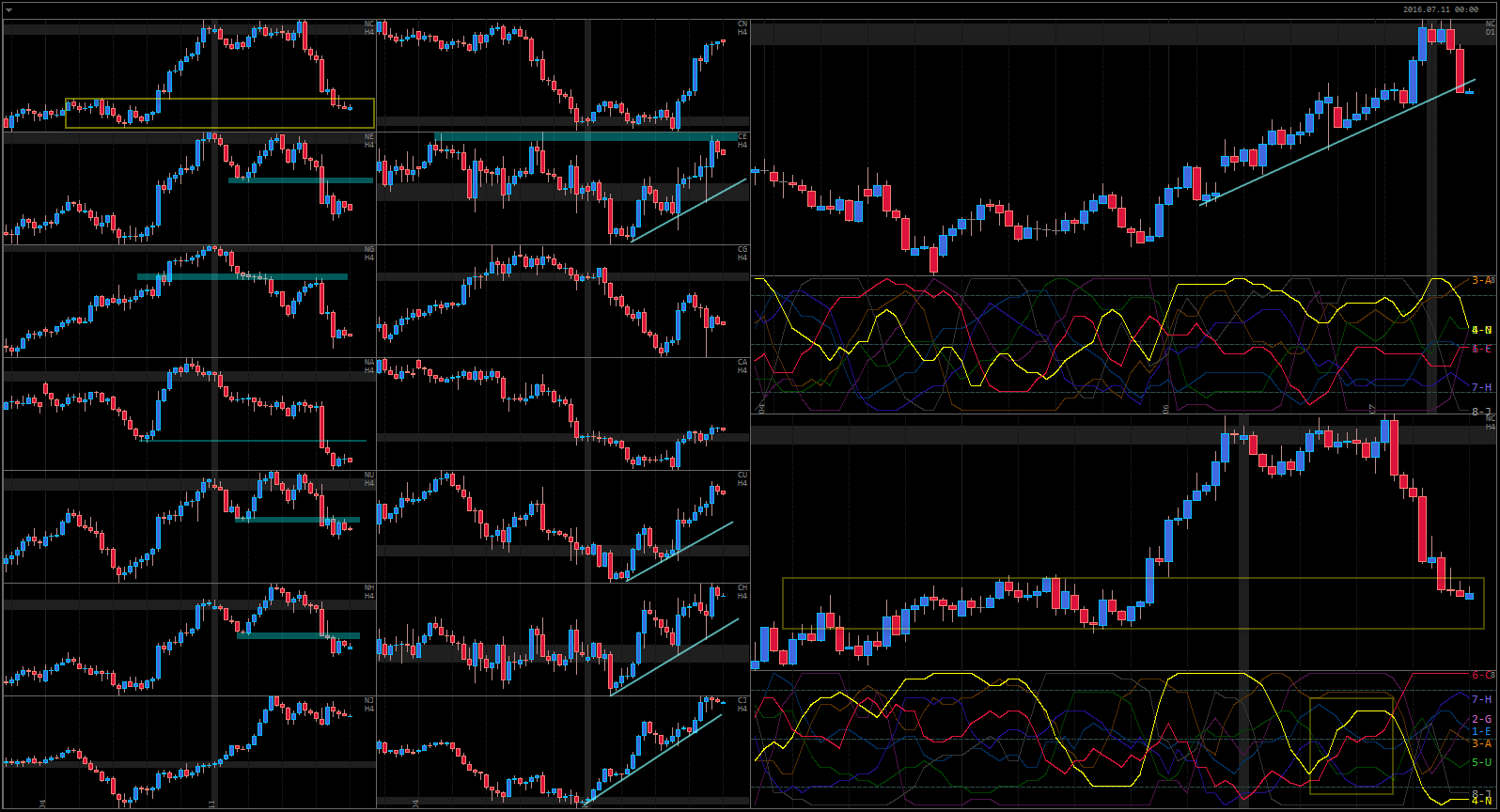

EUR has been probably the most flat currency in many, many months. Looking at its cycle (blue line on the right Daily graph), it has barely managed to reach the high on a couple ocassions, just to be instantly rejected – not the most bullish sign. Looking at the currency profile on the left, the market has found value on this currency on almost all trading pairs with an interesting triangle on Weekly on EA and on Daily on EU (see first chart).

GBP on the other hand is trading in a seemingly permament bearish cycle. It is testing post-Brexit lows right now, for the third time in 3 months. The main question is – how much longer can this trend continue? How low should it go that traders would refuse to sell? If the price shows acceptance just below the Brexit lows, we are in for another ride.

Interesting to note though, that GBP is starting a bullish correction right now. The price action of the next 2-3 weeks could help to see the picture more clearly.