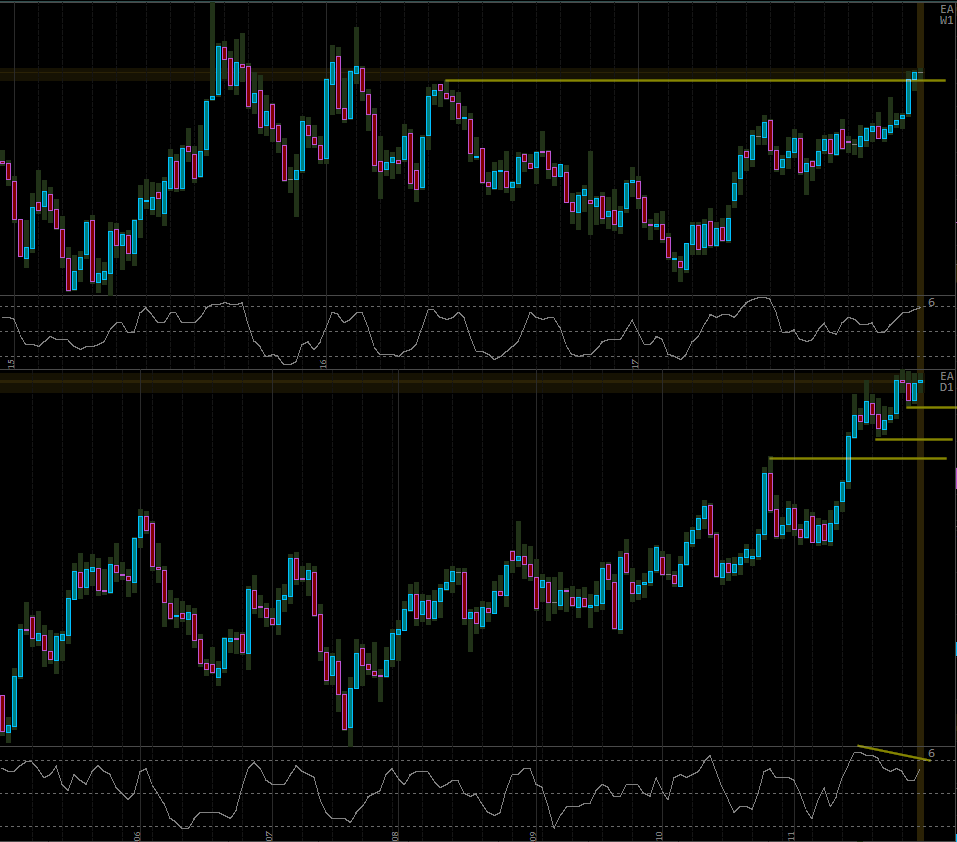

As we approach the bottom boundary of this 2 months long range, I am watching closely for a breakout. EG might be preparing a Weekly trend reversal.

Price failed to reach the lower support, and trend remains down, albeit very slow one. On H4 price is being rejected from the most recent swing high – expecting another retest of the lower support.

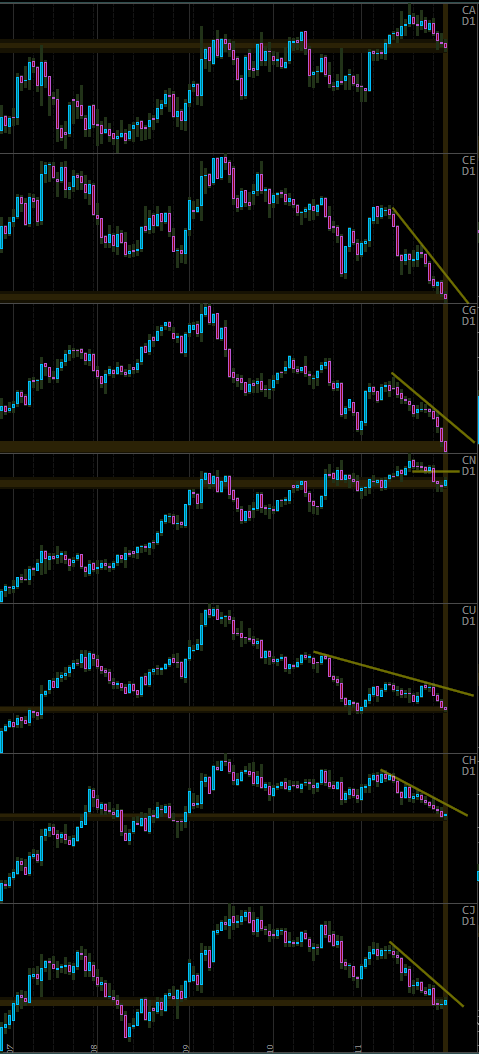

Similar to EN, price is very tempting to Sell, but all we’ve got so far is somewhat slowing Bullish momentum, with Bears showing little signs of strength. If the price starts breaking through the indicated levels on Daily, Bearish argument will have much more going for it.

Bears had something going for them when they pushed into the indicated support (first down swing), failed to break it, but then attacked again with increased strength. It was painful, no doubt, to see all their efforts erased in the current Bullish swing, going as far as breaking the previous swing high.

Given the stronger momentum of this Bullish swing, I am fully expecting another retest of the high. The overall Bullish environment on Weekly also helps.

This is a decent little Bullish correction, offering an acceptable Selling price, but I am not eager to add to my NZD shorts or JPY longs. At any rate, not on the approach of the major support on Weekly. If price slowly reaches towards the TL I may reconsider.

Just like many other EUR pairs, the price is tempting, and the consistent slowdown in Bullish momentum helps too. And yet Bulls manage to push higher, while Bears fail on each subsequent approach to the TL. Right now we are at a point when something has too give, with triple high above and TL right below. A reversal might not be very far, and any failure to break higher will offer a selling opportunity.

Note also that we are right where we were before the collapse on 15th of January 2015 – that was a long way up and it took 3 years to undo one day’s damage.

This is one of the worst situation for any trader, when you make the right call and yet miss an obvious rejection entry trigger, only to see the price rally without ever looking back, hoping that it offers at least some kind of correction. Live and learn…

Price continues higher, and while the correction looks tempting on Daily, I am not eager to become more exposed on CAD – not just yet. Let’s see if that’s little congestion area on the left offers any decent resistance.

Speaking of CAD, it has managed quite a push lower in the recent days, and unless it shows some Bullish strength, I just might have to reconsider my views.

Yet another EUR pair which may offer a Selling opportunity very soon. Note strong Bearish waves (each making lower lows) any time Bulls are getting near the previous highs. As we are getting above the middle of this range, I am looking for any weakness/rejection as an excuse to establish a Short.