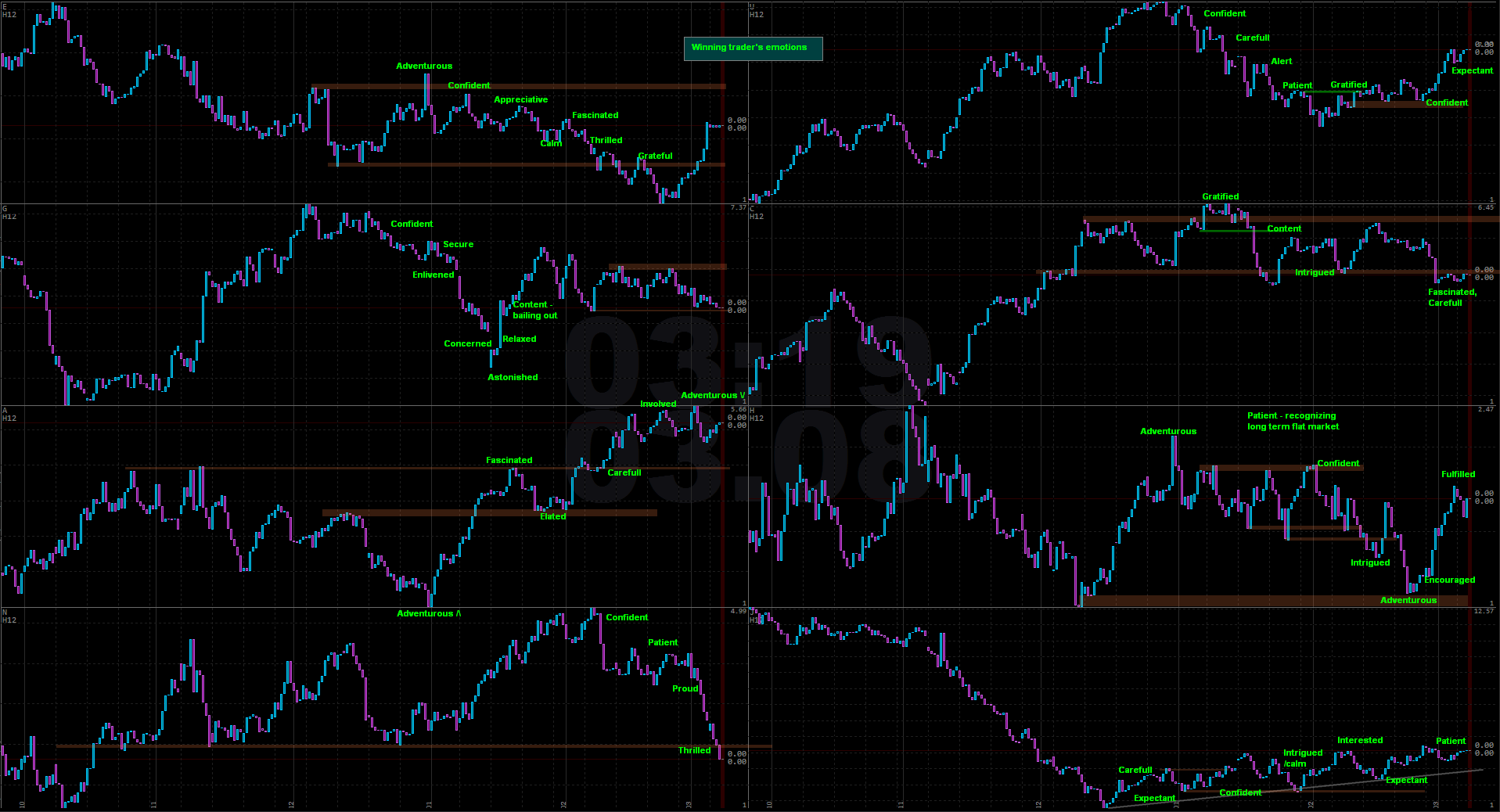

No matter how much I am trading the Market, it never fails to fascinate me, always providing new lessons. It can be a harsh teacher sometimes, but always fair. Unforgiving of any mistakes, it always keeps me in check.

Being a trader is a conscious choice I have made. Being a miserable, losing trader is a choice I was making for many years through unnecessarily fighting the Market. I have never won – not even once.

Every day I face the same choice over and over again – to follow the Market, being grateful for every lesson it patiently teaches me, or to fight against it, making it into a vicious enemy I can never win against.

Being a trader is not always easy, but it is only me who can turn this vocation into a miserable pursuit of psychological stress and financial pain. And it is easy to find myself struggling – all I have to do is start expecting something from the Market.

Expecting to be right. Expecting to know the future, predicting the price. Searching for certainty where there is none. Refusing to accept the contradiction. Trying to avoid discomfort.

Unacceptance of the way the Market is – the only cause of frustration, confusion and, ultimately, suffering that many traders experience daily.