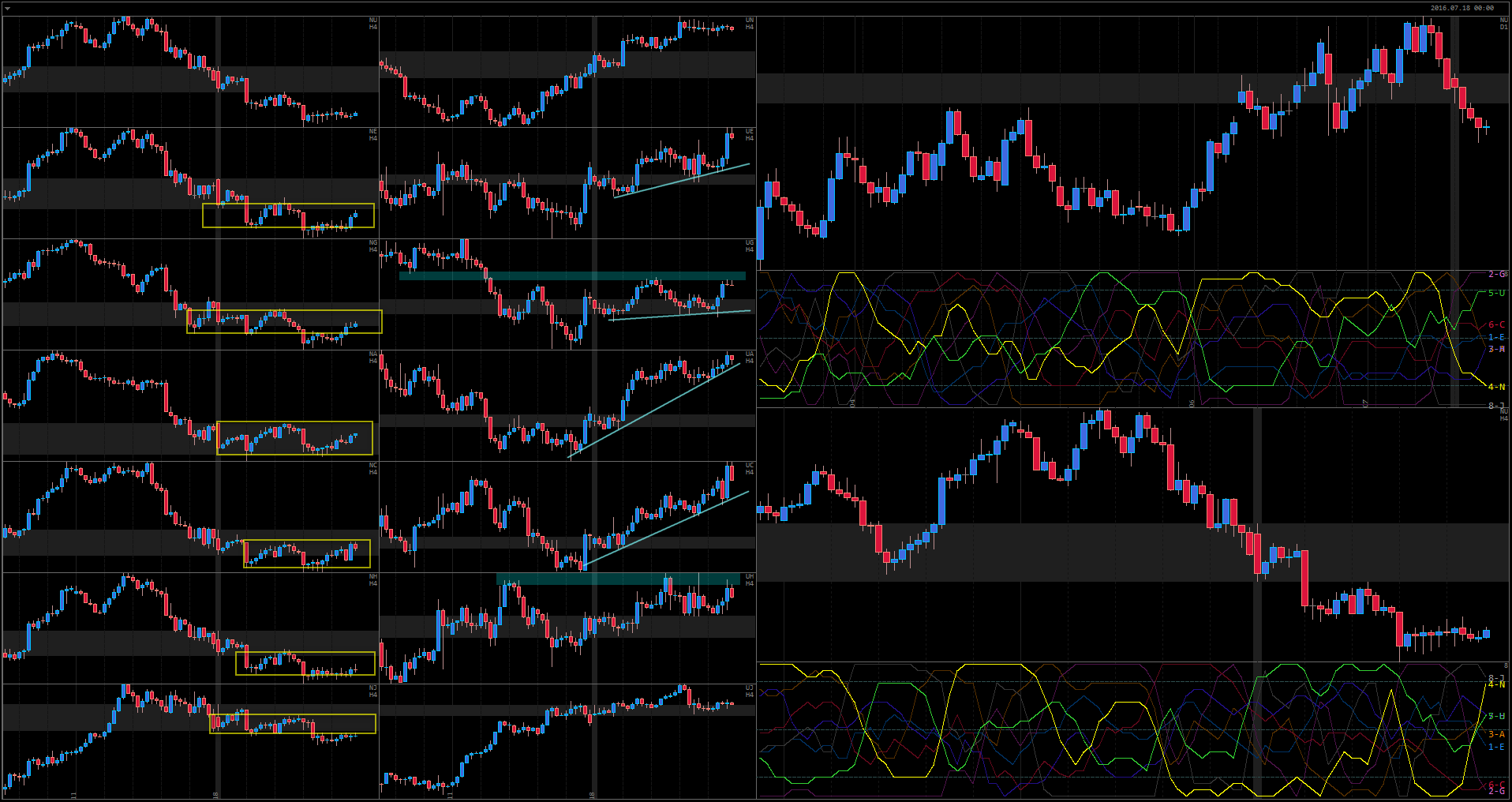

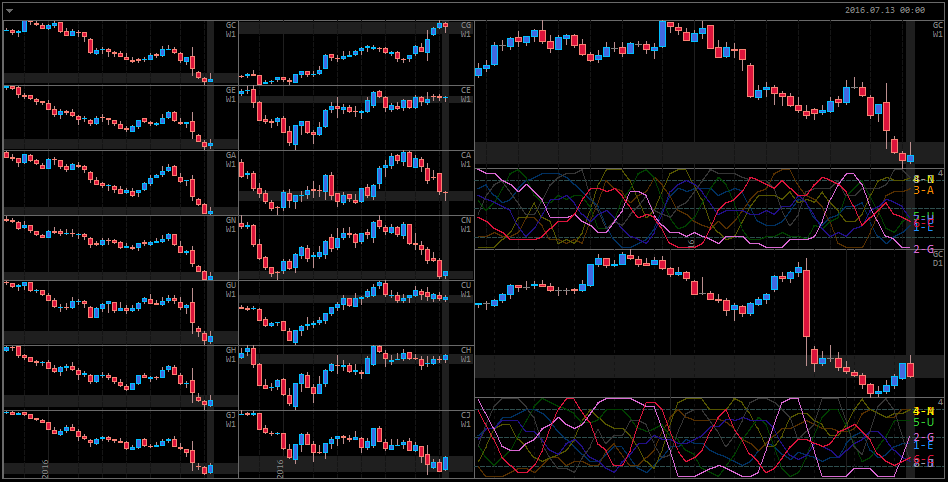

Despite the fact that NU is the strongest pair of the last week, it’s been really struggling in its descend.

NZD is mostly flat on basically all pairs other than NU.

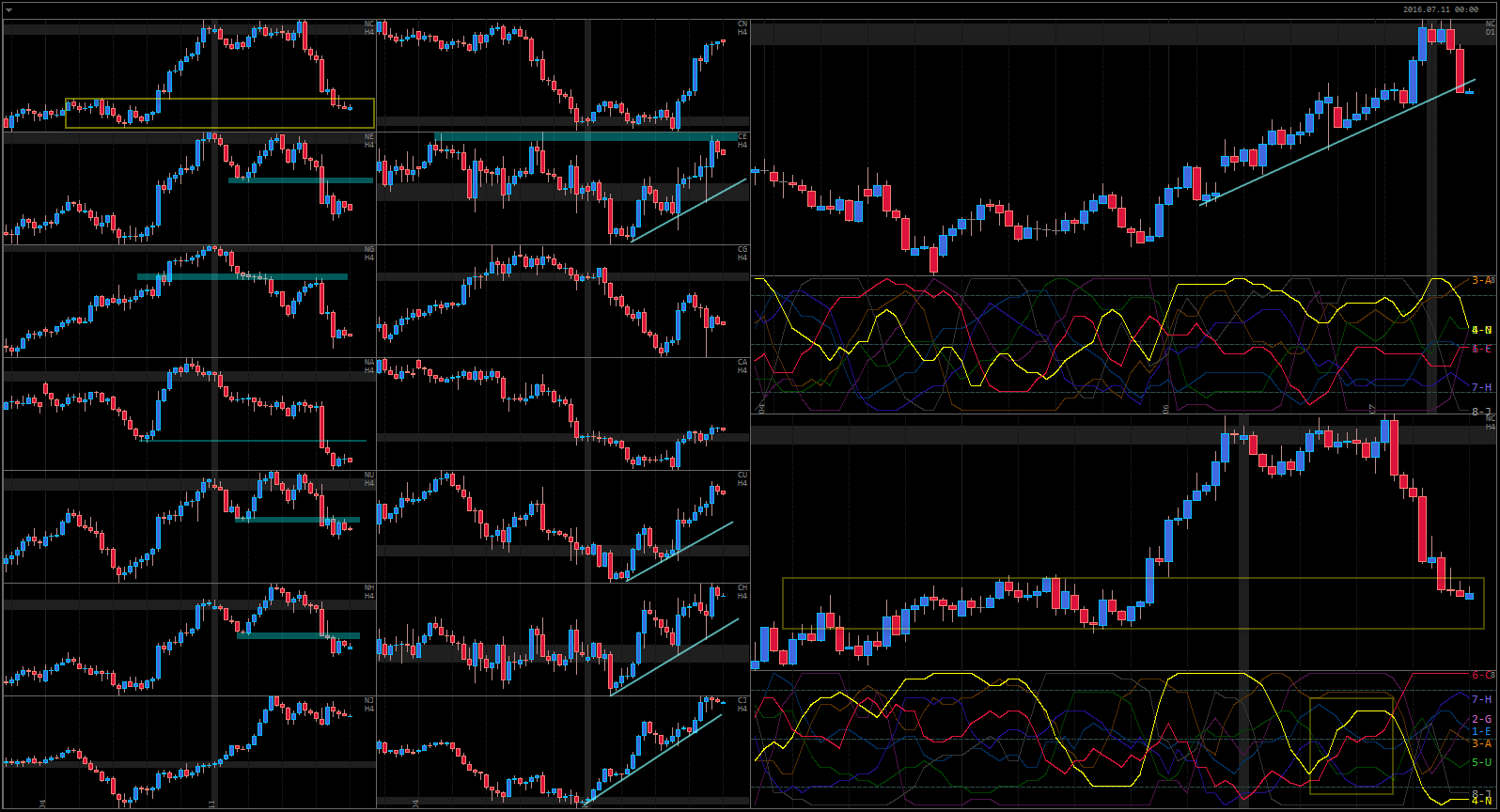

USD has been growing during the past week, but it really struggled in all pairs other than the commodity group. UH is looking especially interesting, with its 3 consecutive failures to break the high of the last week.

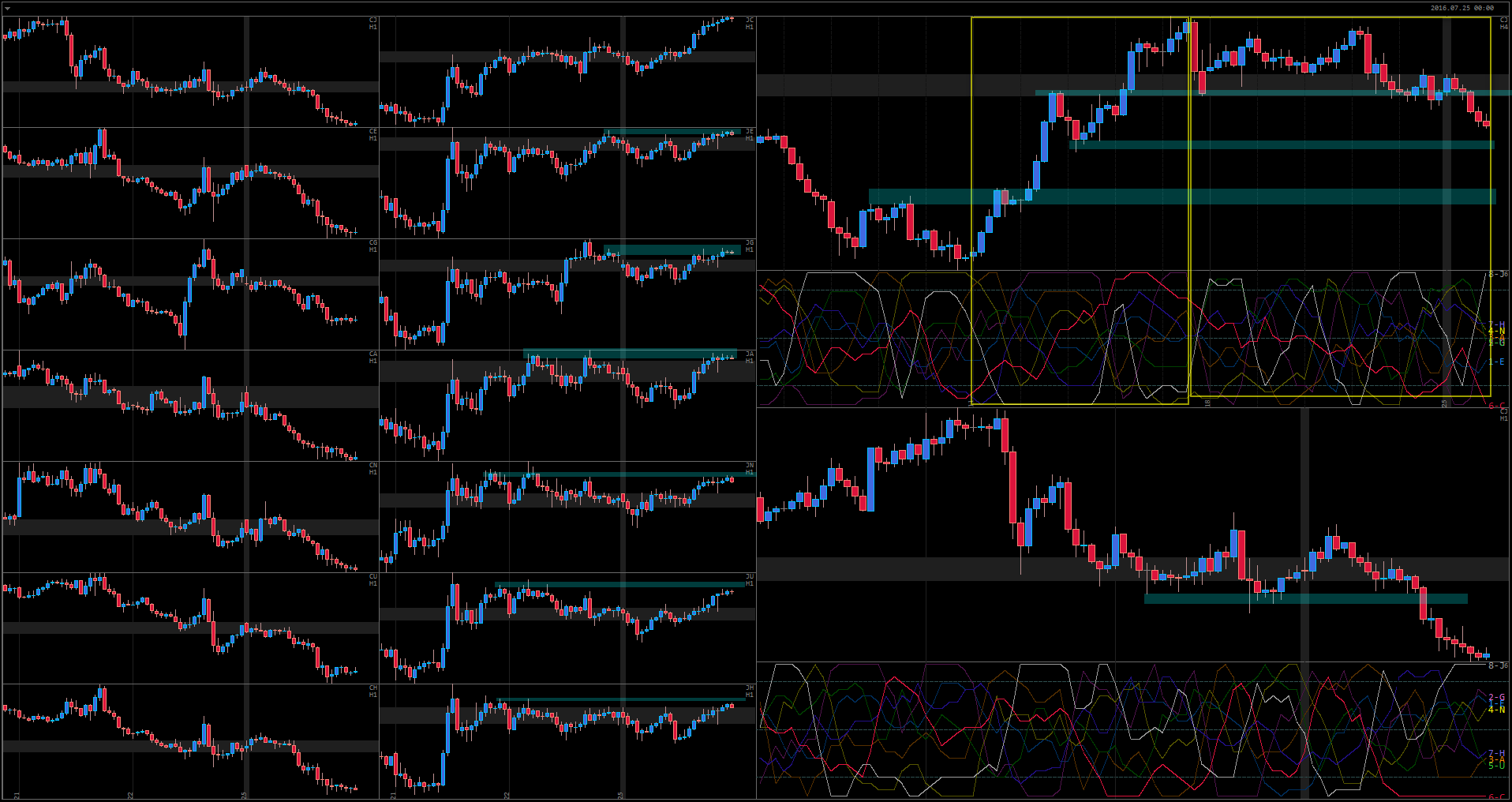

Here is the strongest pair of the day for Monday:

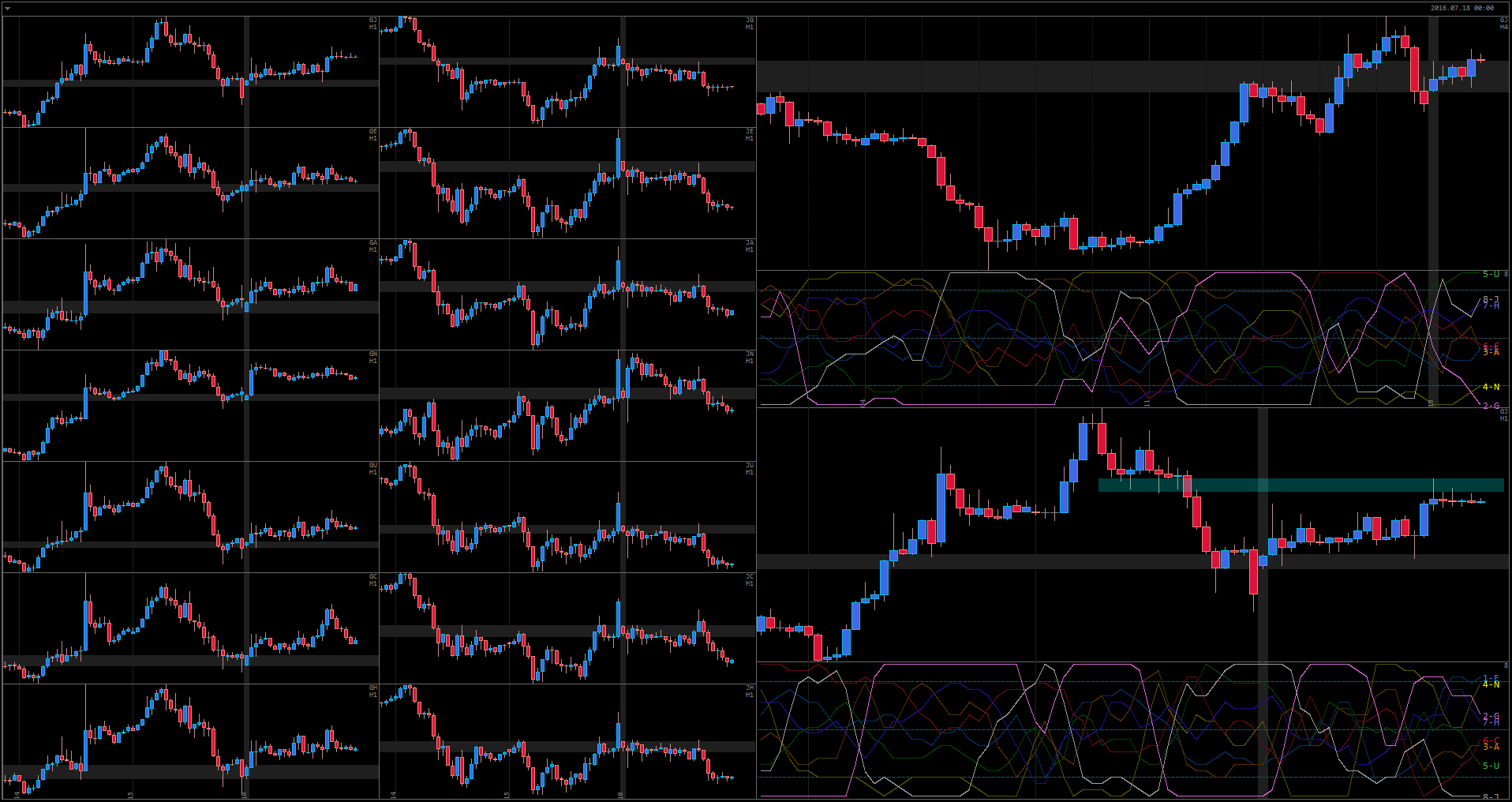

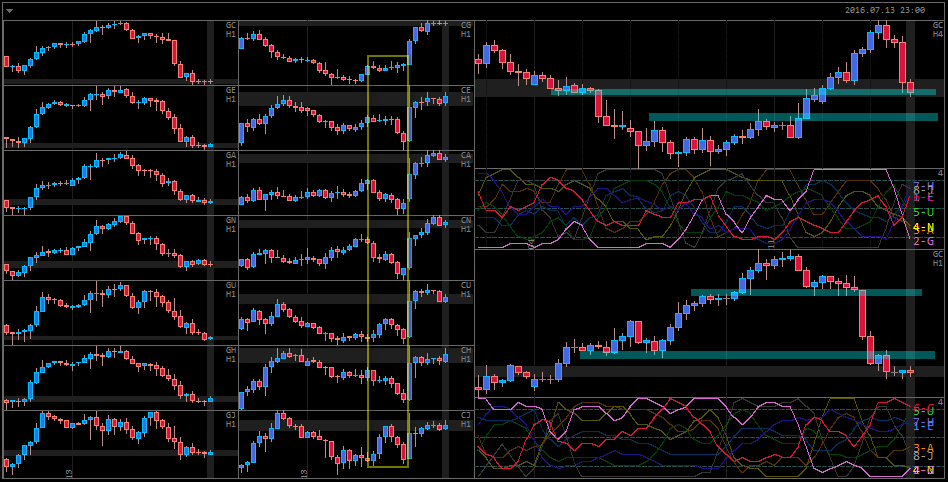

CJ made a determined move today, but only on the smaller scale. If we look at it on higher TFs, we can clearly see that today’s bearish move is just a part of quite a weak bearish cycle on H4. Compare the momentum to the previous bullish cycle.

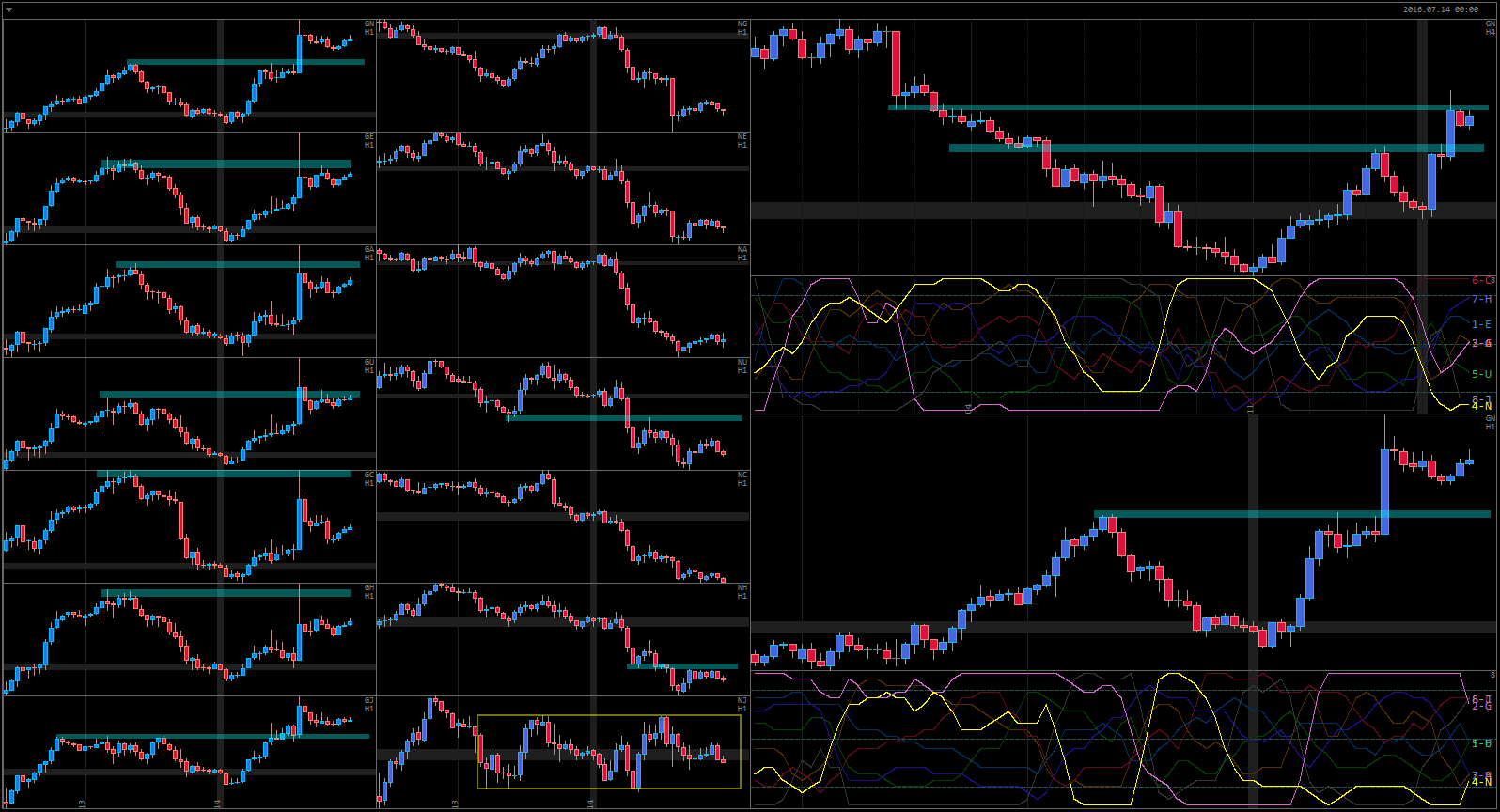

JPY does not look like it will be growing much longer. BOJ is meeting Thursday-Friday and they are expected to introduce new easing measures. Interestingly enough, the Market is not pricing these planned measures at all, and the price in all JPY pairs are growing towards significant resistance.

JN looks like an interesting trading pair on higher TFs.