As usual on Sunday morning, I am spending most time researching fundamental information online.

I started with this great infographic:

Nearly 3000% expected increase in demand for Lithium? That could drive prices up quite a bit! Cobalt nearly 2000%.

More at this link.

Then I checked out the car that UBS tore down to research materials (all prices in pesos):

This is pretty much the direction the world is going into. It is not even so much about Tesla or Chevrolet – pretty much every major car maker has semi or full EV, or developing one.

—

So I thought that maybe this is something worth looking into as an investment.

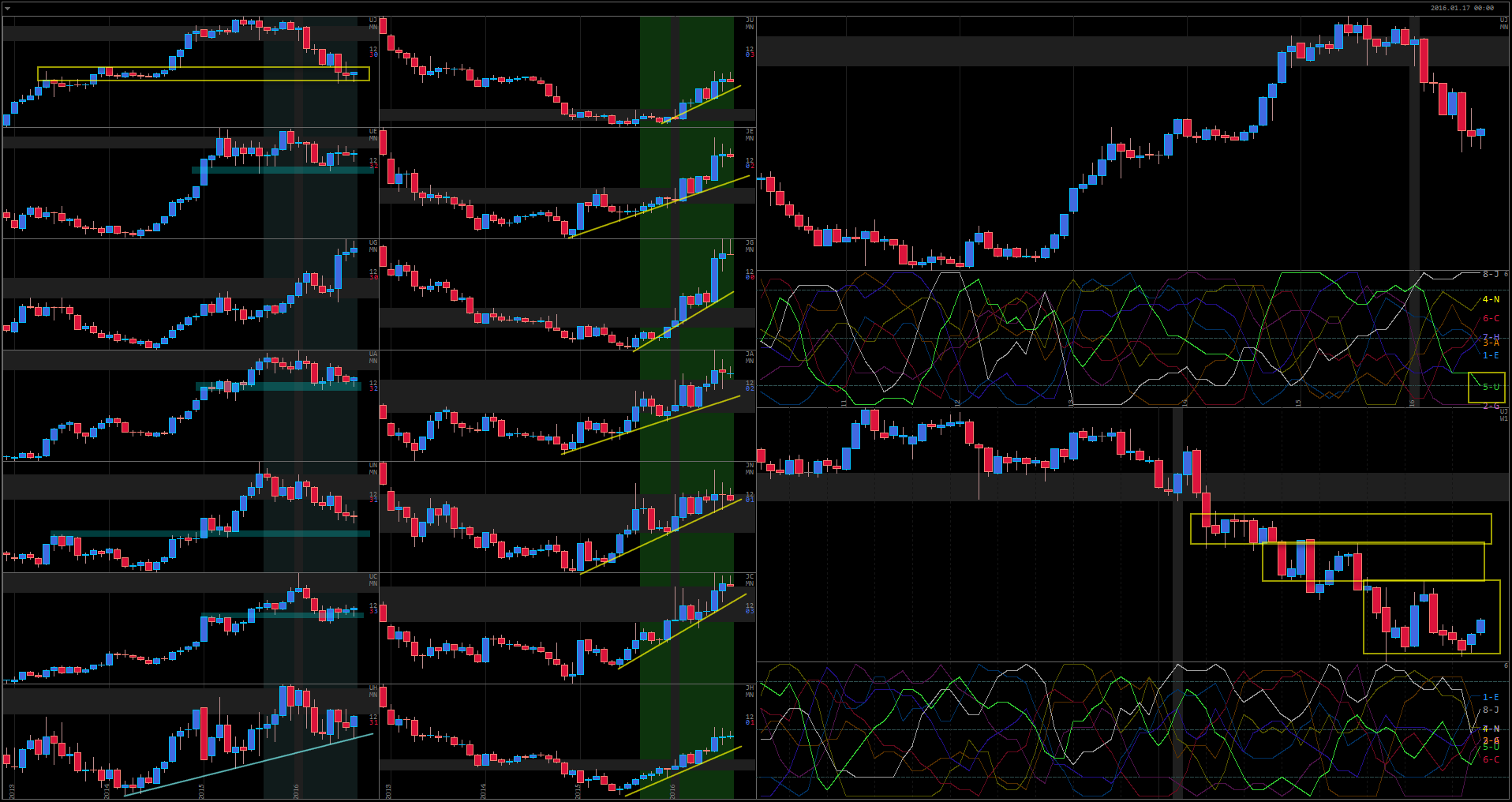

Let’s look at the chart, first for Lithium:

One after another many major R levels broken since 2016, including major Bearish trendline. Next target – all time highs near $45. This is the furthest back I could find with a quick search.

And Cobalt:

Unsurprising correlation.

Zooming in on Lithium…

Major Bullish trend, no question about it! Best investment opportunities were in 2016, but there are bound to be more corrections along the way.

Wait, what happened during the last week??? Huge gap and the biggest Bullish week in recent years. On top of that, the biggest trading volume EVER.

Apparently, as I was reading earlier this week (but not connecting the dots properly in my head), China has just unveiled a plan to ban petrol cars! Sounds crazy! But the crazier part is that in case of China it means that they are going to replace gas powered cars with coal powered cars, because that’s where China gets 65% of its power. 😀

Well, leaving environmental issues aside, the news is driving Lithium way up.

Coming back to the recent volume/price spike, here is an article going into it in more detail.

===================

So how could one trade Lithium? Apparently, you can’t – at least not pure Lithium (i.e. Futures). All the details are in this great article by Reuters.

And this article discusses top Lithium producing countries.

And top Lithium producing companies.