Just read an article on ZeroHedge reviewing performance of stocks, currencies and other assets for 2017:

The Dollar was a bloodbath this year – the biggest loss for the greenback since 2003…

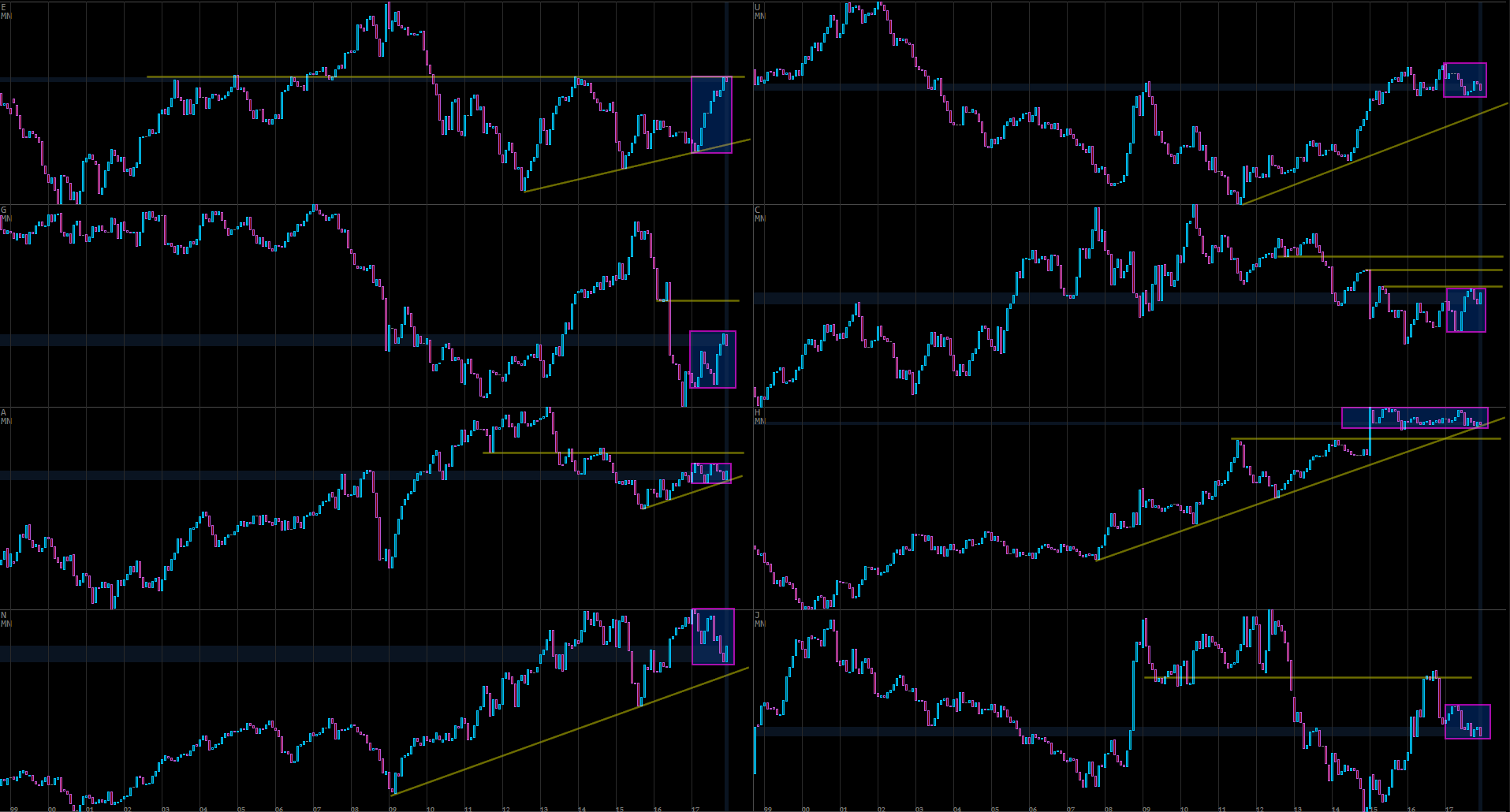

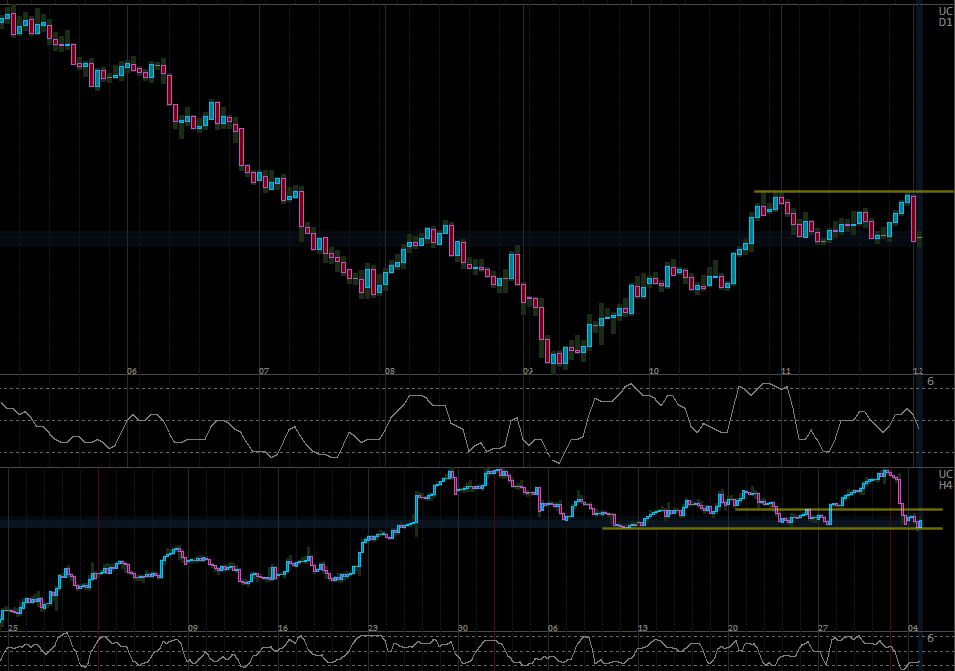

Well, if that’s a bloodbath (see the chart below, USD top right – click to enlarge), I am quite Bullish on USD for 2018 (even though it is likely going lower before it goes higher)!

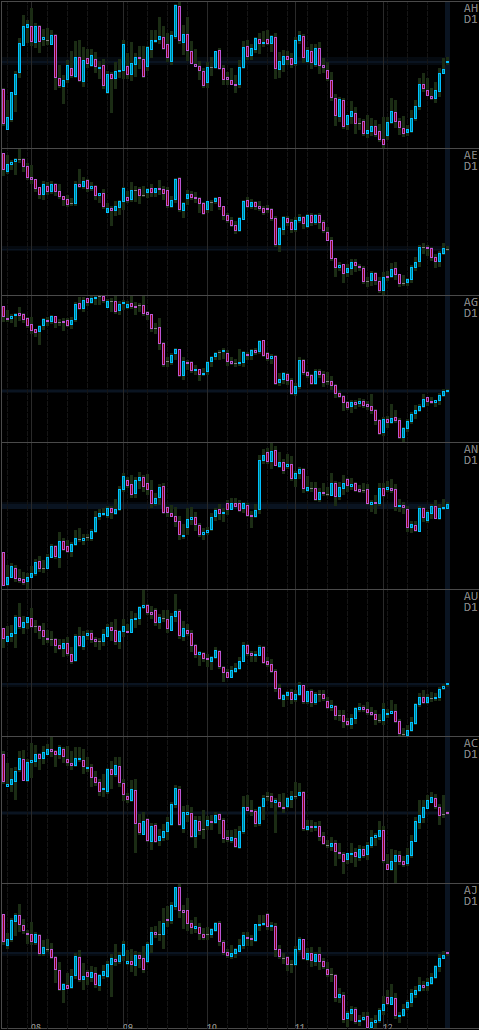

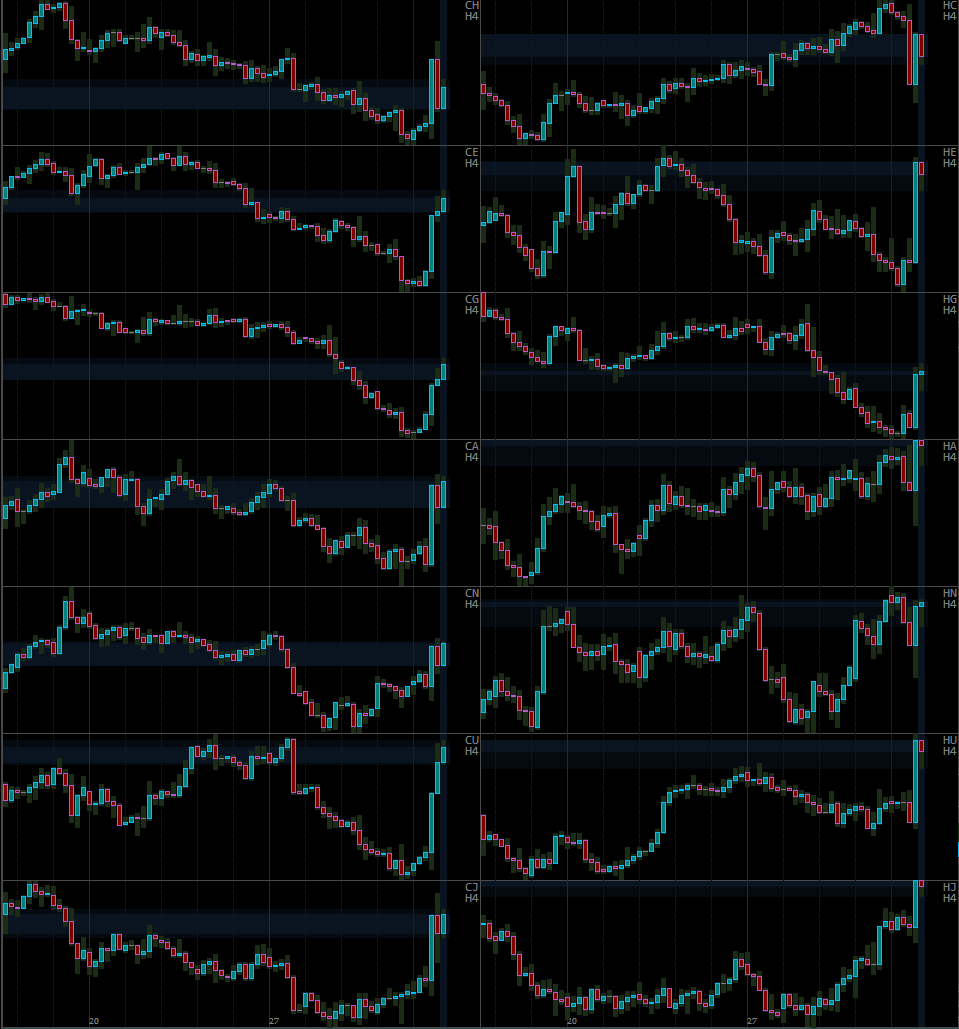

NZD depreciated much more, even though it bounced in December. JPY did not have a very strong year either.

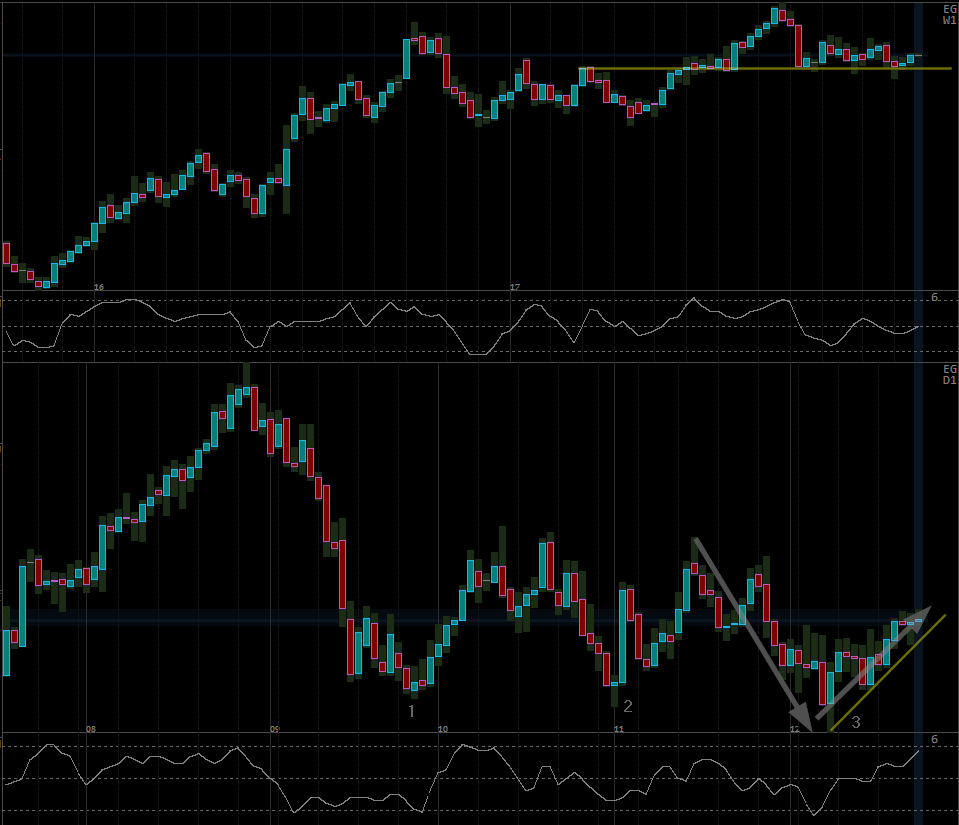

EUR is a clear winner for now, but being extremely overbought and reaching a major resistance on Monthly, I am Bearish in the long term.

GBP had a nice bounce from all time low, but in light of the prior Bearish trend I do not think this will last.

AUD, NZD and CHF are more or less unchanged, while CAD is somewhat Bullish.

AUD has been flat, trying to push higher against the stronger Bearish cycle lasting 3 years from 2013 to 2016. I would expect a breakout towards the yellow resistance and a likely rejection from there. Could start a major Bearish cycle in 2018.

NZD is the weakest currency in 2017, and it doesn’t look like the descent is done. However, I note the prior Bullish wave in 2015-2016 against which the current drop is trading, and the Bullish trendline it is approaching.

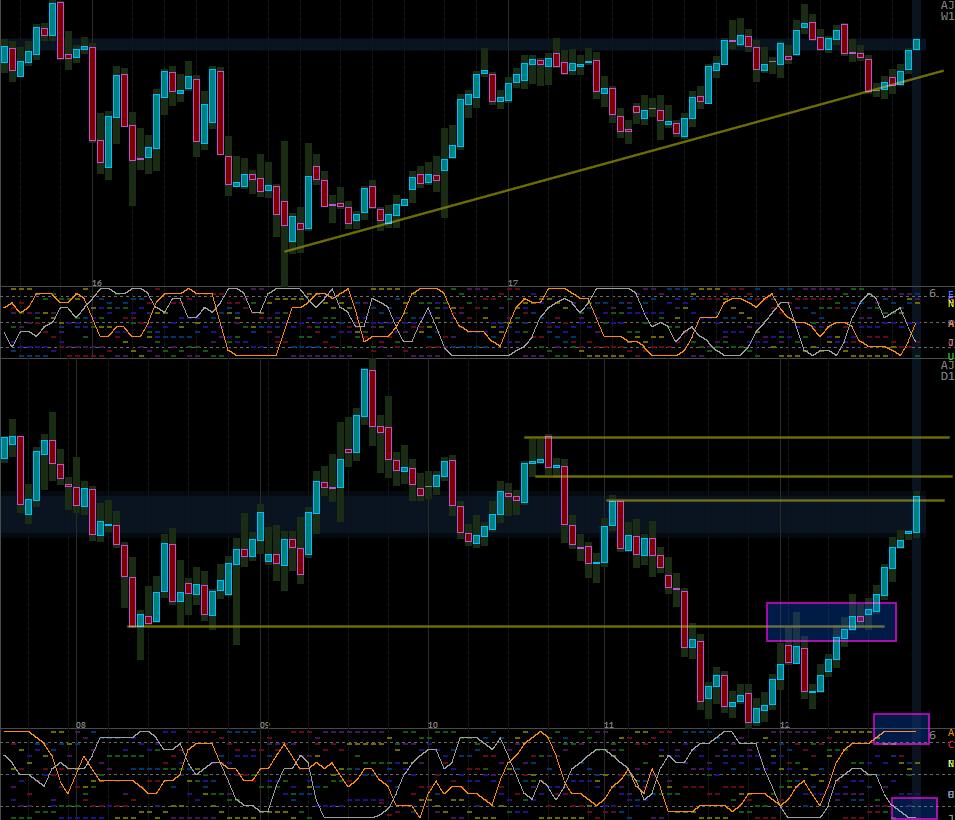

JPY, while registering a negative year, is trading against a very strong Bullish wave. And momentum of this current Bearish cycle is slowing down. Expecting a bounce towards 2016 highs.

CHF is still pretty much unchanged after January 15th 2015 SNB fiasco. And yet, the price is sitting on a very long term Bullish trendline – no other currency is showing such consistent Bullish trend, lasting since 2000. Expecting a bounce and retest of the highs, but a temporary break towards lower support cannot be discounted.

Finally, CAD is slowly pushing against multiple resistance levels. Bullish momentum remains more likely, but I think it will have a hard time turning into a strong, multi-year Bullish cycle. Additionally, I do not think that Oil prices will reach much higher from where they are right now, unless a major war breaks out in middle east (which certainly cannot be ruled out).