One of the most important concepts in trading is following the market. I was always looking at the market trying to predict its future: what is it going to do the next candle? What trade can I place right now? Often I would go back in history and watch some trading pair bar by bar and still make the same predictions. Not only that, but I would actually feel frustration when the market was not doing what I expected it to do.

A very good exercise is to watch the market unfold, mentally (or in writing) noting what it is doing right this moment (this candle), and go to the next candle with open mind. I call this market meditation, because it takes all our presence, all our ability to control the thought process in order to just watch what the market is doing instead of trying to tell it what to do.

When doing this exercise, I often catch myself surprised after the next candle is revealed. I am surprised because I did not expect the candle to be that way, and yet the whole purpose of the exercise is to stop all my expectations. Why is it so difficult to just let the market be?

This exercise also proves yet again that the market can do absolutely anything. It can go in any direction by any amount at any given moment. When we catch ourselves surprised, not expecting the current move that has just been revealed, it is very important to listen inside – to the thoughts that float in our brain and the emotions that we feel. Is there anger, frustration, disappointment? Is our brain trying to judge us because we were not able to “predict” this move? Try to stop this incessant thinking – if there is anything to judge, it is our inability to let the market go, and follow the flow.

And yet, there is another side to this. Sometimes we see the market close just as we wanted, and we feel a rush of adrenaline, a pleasurable sensation that tells us we were “right”. In this exercise the excitement is no better than the frustration we’ve just experienced when the marked defied our expectations. Any emotion about the market implies a conscious or subconscious judgement on our part.

Remember, the purpose is to watch what the market is doing – without trying to predict, understand or judge. The market is supplying us with an endless flow of information. I believe that we can never deal with this flow constructively, unless we first learn to let it be just the way it is.

So give it a try:

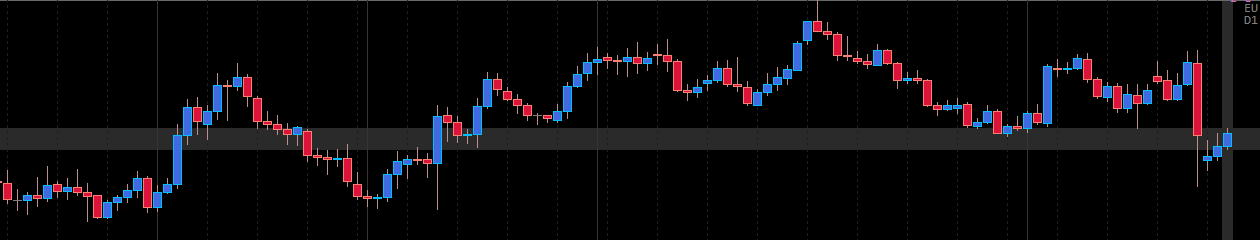

- Open any trading pair on any timeframe

- Go back in history a couple thousand candles and start revealing one candle after another, pausing at least for a couple seconds on each

- Make a mental note how the current candle has closed

- Note any emotions, feelings or thoughts that you might have, accept them and let them go

- Go to the next candle whenever you feel like it

You can also add any indicators you usually watch – but avoid any indicators that give you a signal to buy or sell. For example, you can add a moving average and then note its position relative to the price chart on each candle. At the same time, do not say that it is a sell signal because the price has crossed the moving average. Remember that any trading signals are not generated by the market, but by our brain – one way or another, for better or worse, our brain has learned to recognize a particular pattern as a buy or sell signal. In this exercise we want to avoid such patterns, because they are nothing more than our subjective judgement. An indicator simply gives us another variable, another source of information for us to note. This is the real purpose of any indicator – to help up clarify what the market is doing right now, not what it is going to do in the future.