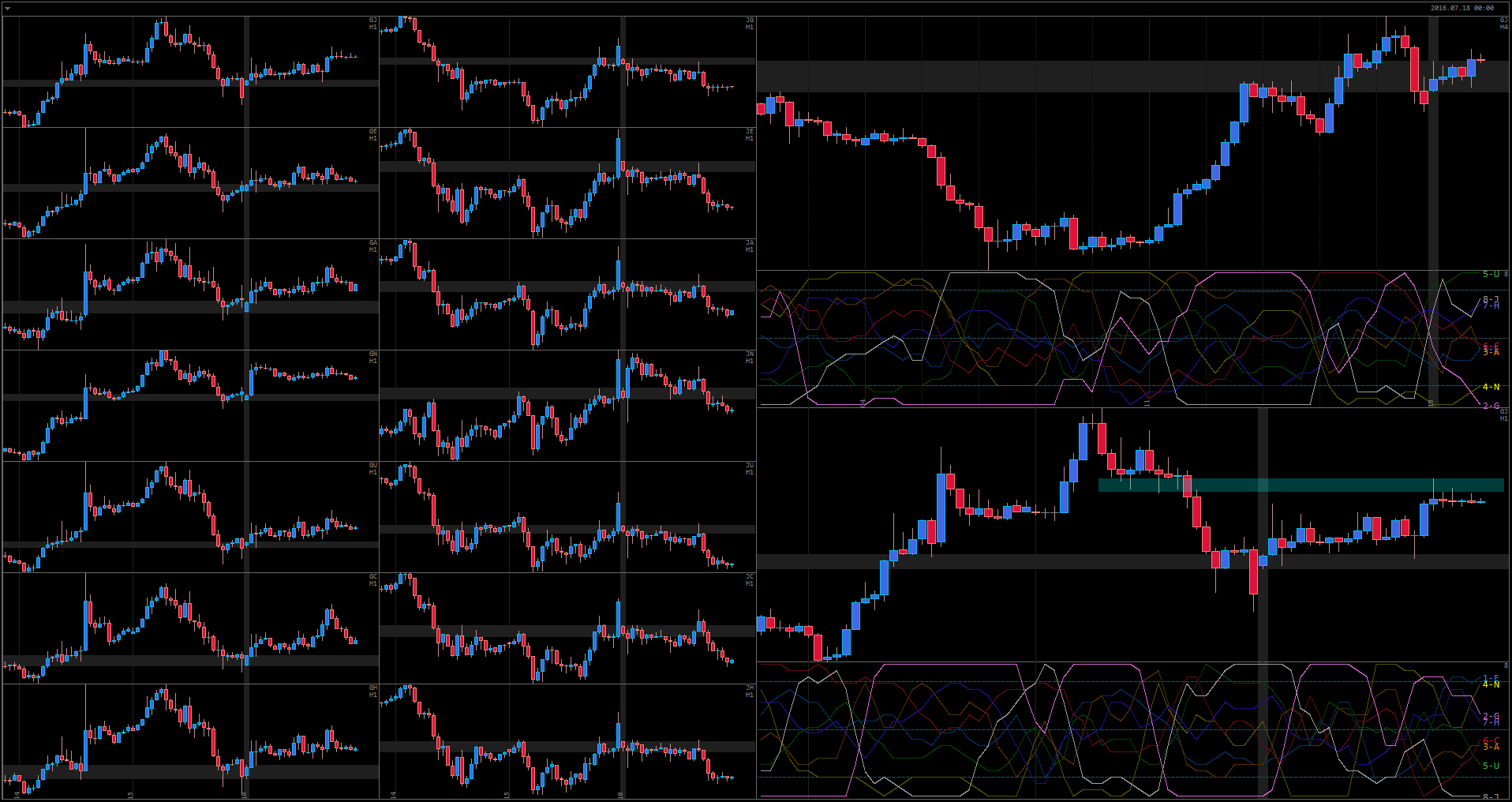

GBP continues messing up the markets after the Brexit. Another pointless spike has happened early in the morning, just to close your stop losses with a huge gap and then retrace back to where it was before. Such situations are only further confirming that trading on lower timeframes is not safe any longer. If your stop loss would have been 100 pips, you would have lost “just” 5-6 times your planned risk (depending on how well your broker would execute your stop order). With a stop of 20-30 pips, you would have lost 20% instead of your planned 1%.

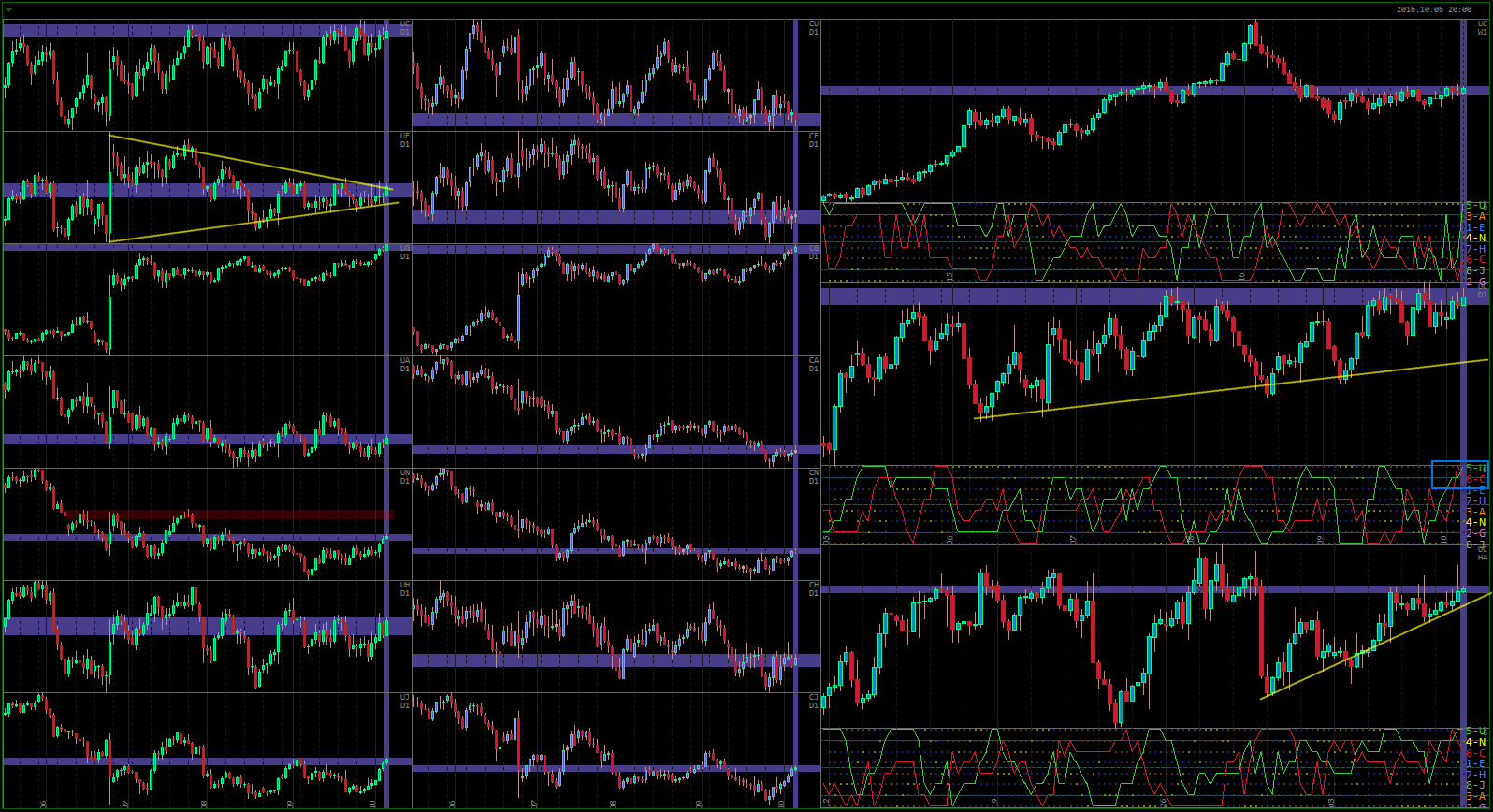

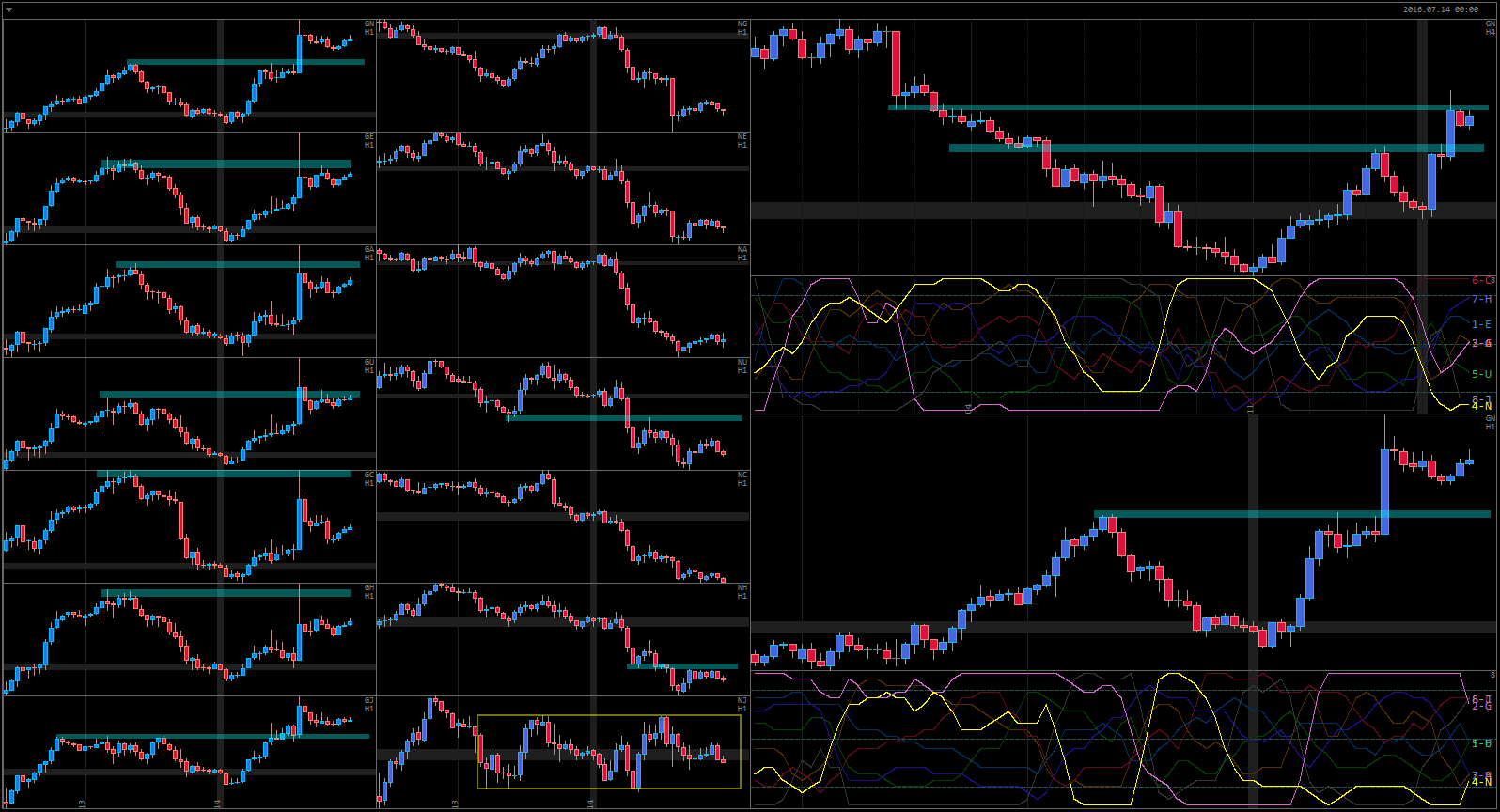

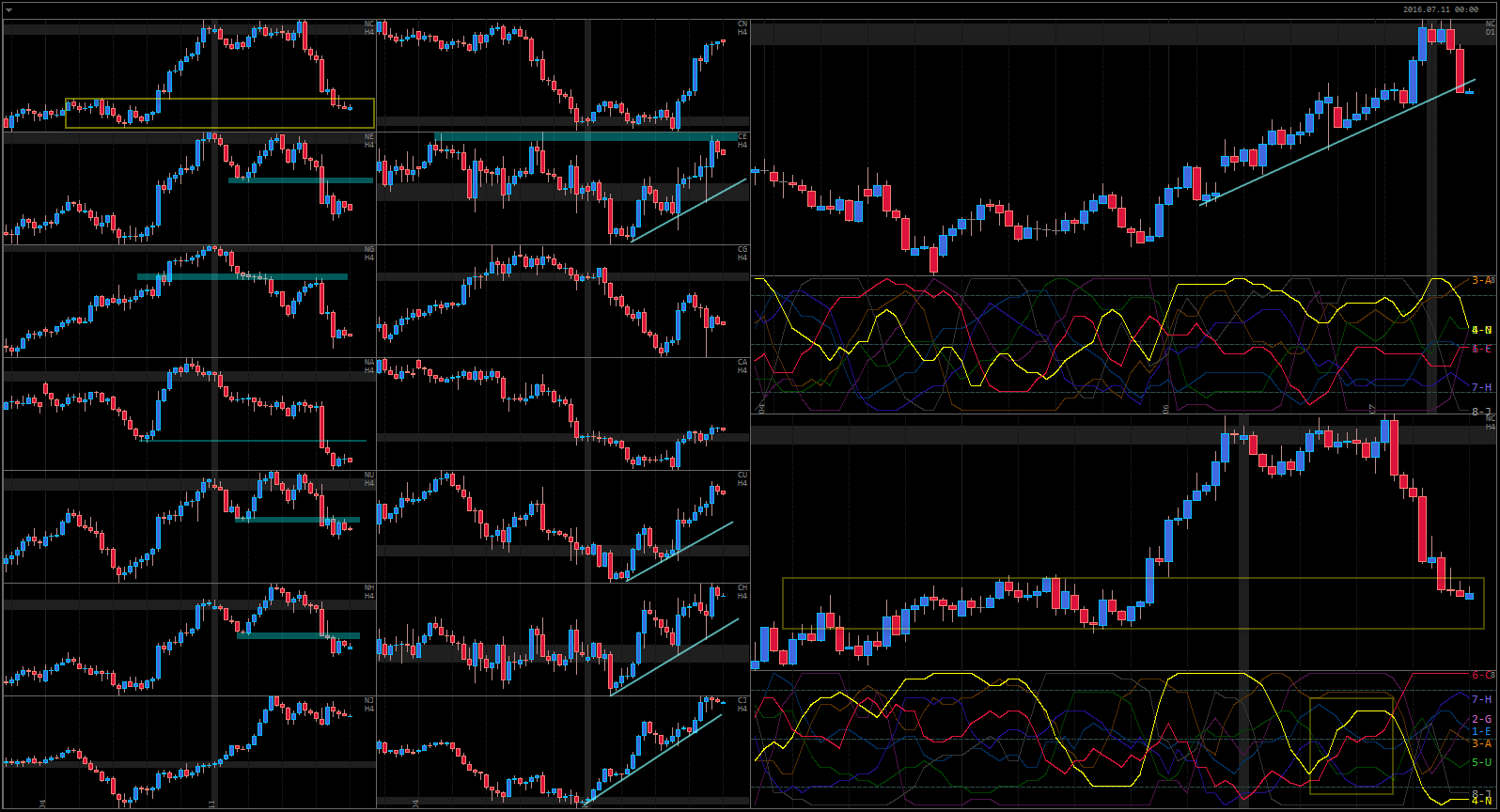

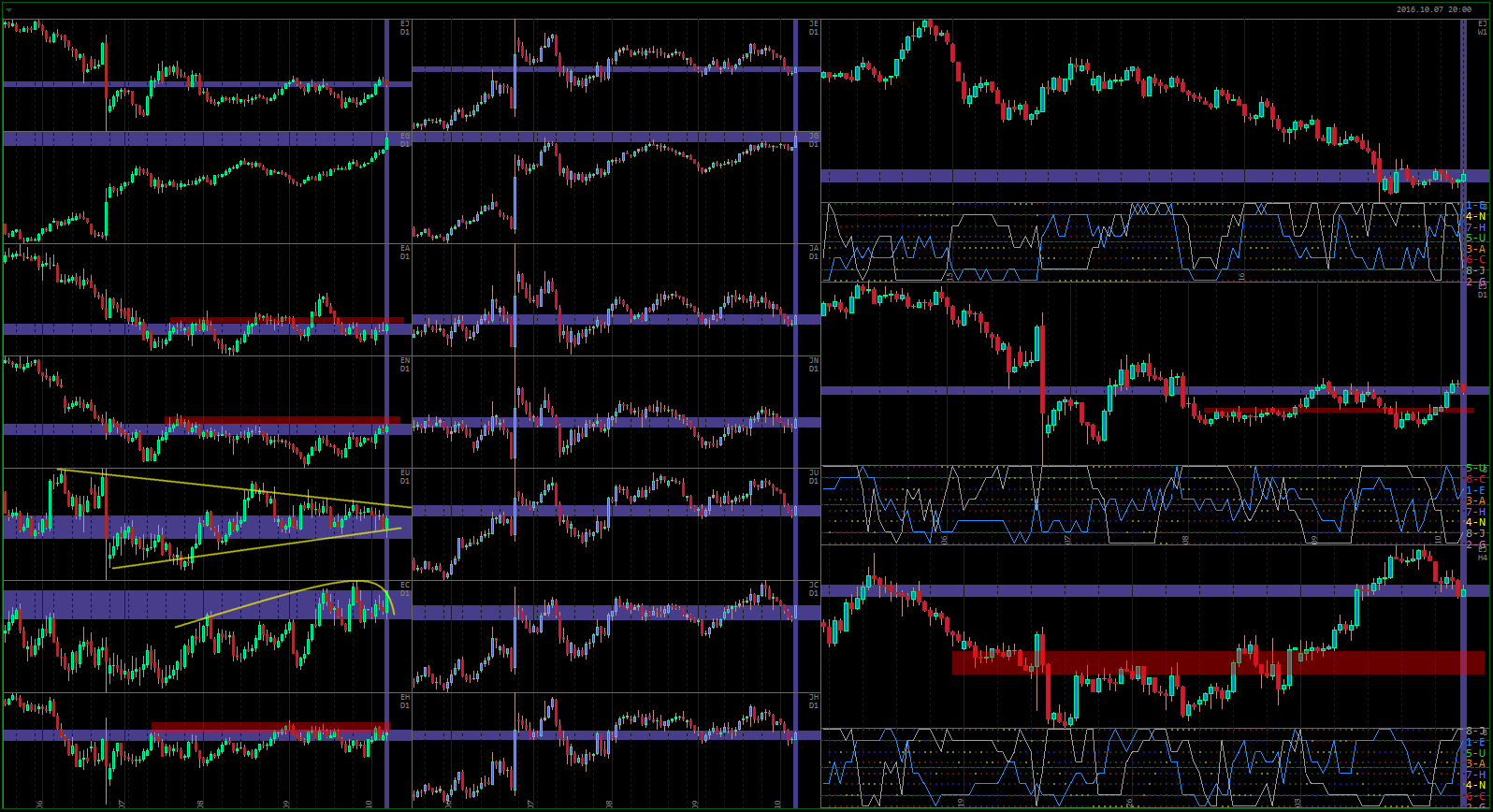

As mentioned earlier this week, EUR has managed to form a bullish cycle on Weekly. However, the price action has been quite week and it does not seem likely that EUR can pull off breaking very strong resistance on almost every single pair (see the picture).

JPY has bounced from its support areas as well, and will possible continue trading in the Daily range, as seen on the charts.

Overall, EJ is a good trading pair to watch for a potential bearish trend.