If you are trading without first assuring your survival, you are just playing a game, a crazy gamble that a drunkard places over the weekend in Las Vegas casino. No real trader who aspires to reach constant profitability will participate in the Market without first assuring their survival.

The above is absolutely essential and goes without saying. It is assumed by default that your risk and money management, as well as psychological well-being, are taken proper care of.

What’s next?

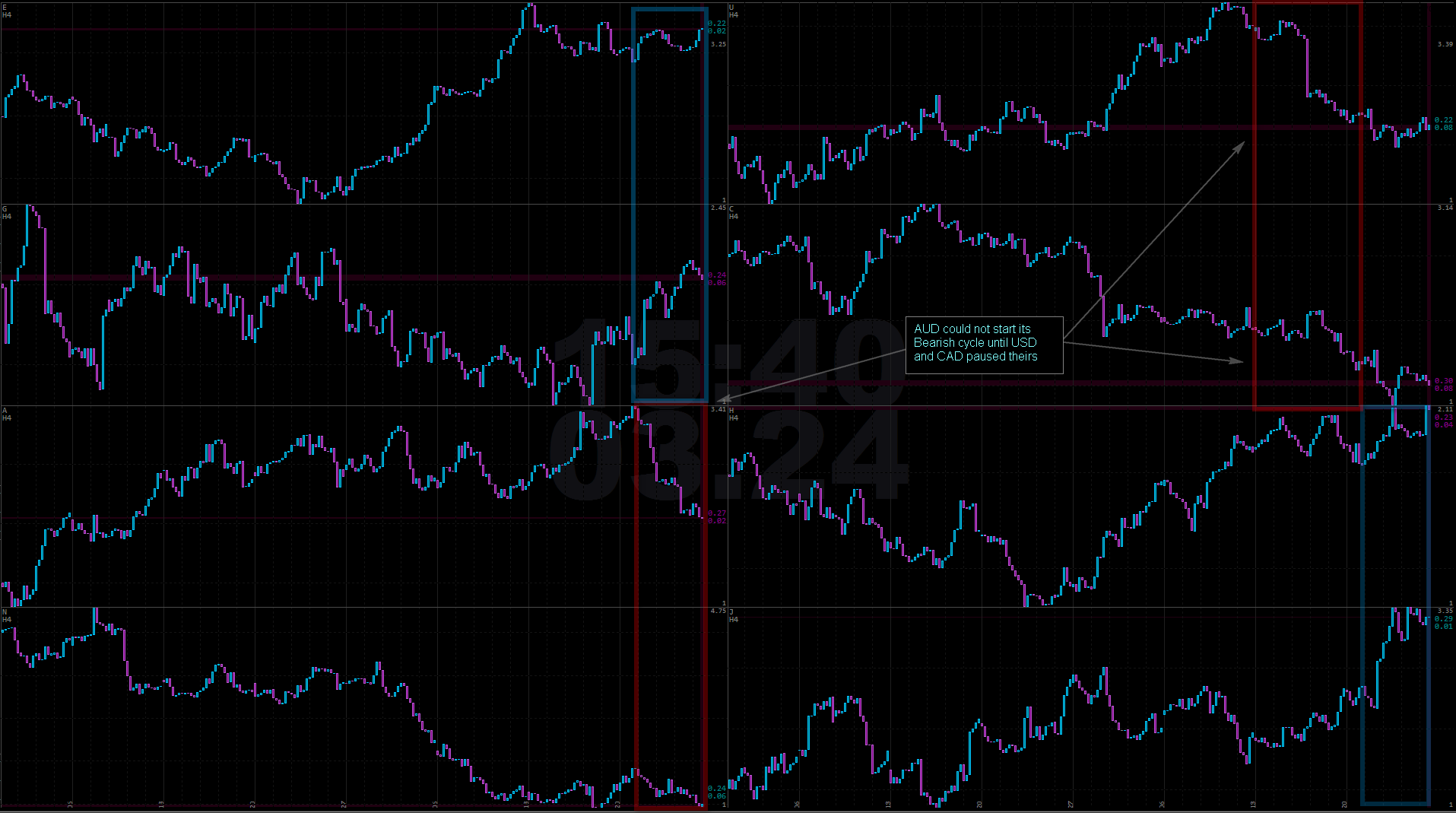

Before anything else, you need the willingness to put in countless hours of work into the Market. Only this will allow you to gain this important subjective feel of the Market as you watch it. The trading ideas will come to you effortlessly and it will only remain for you to execute them. This is how you build your trading system.

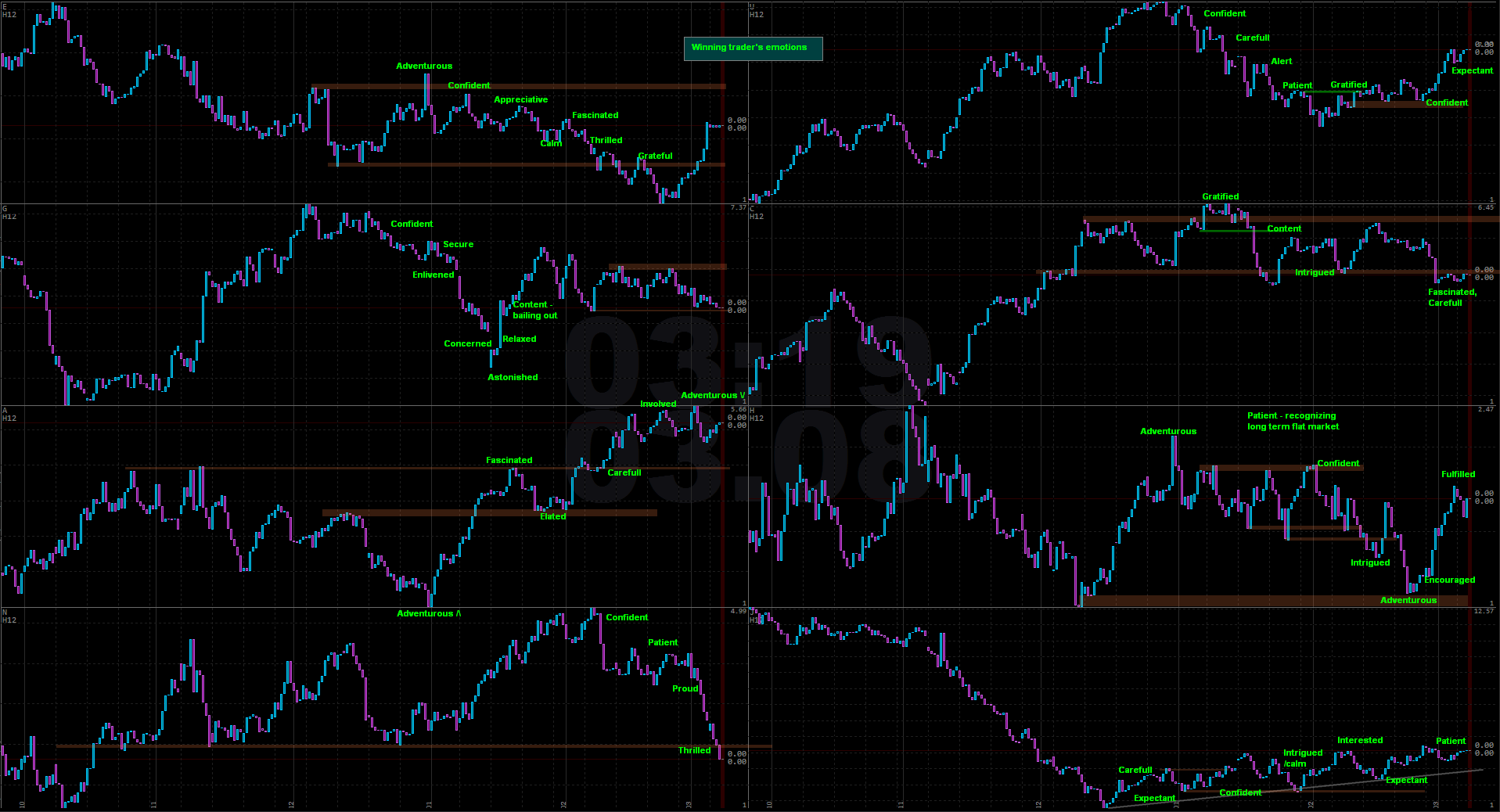

Ask yourself: “Why am I not putting enough time into watching the Market? Why am I not willing to take losses, make mistakes and yet continue with my method, learning and improving with each passing day?” Find the answers. Write them in your diary. Propose the solution and implement it.

When you spend enough time on trading and seemingly totally committed to your success in trading, ask yourself this: “Why am I not acting on each and every idea I have? Why am I closing the trades before my targets are reached or my system tells me to close them? What am I afraid of?”

Honestly answering these questions in your daily diary will lead to important improvements to your trading system. Go back to the first step – putting countless hours of work – and repeat the process times and times again, with humble understanding that you will never be good enough to cease improving your method and your execution of it.

Above all else, remember – it is only possible to go through this difficult process when you have absolutely, perfectly ensured your financial and psychological survival! You cannot be worrying about your well-being or losing more than you can afford to lose AND going through the mandatory learning process of taking losses, making mistakes and being clueless.