Developing a Trading Style

Someone who is watching the markets for considerable amount of time learns to see certain patterns almost automatically. Oftentimes we do not even have to name what’s going on in the market, we just know that the current Price Action looks like something we would want to Sell or Buy. There is nothing bad with learning to recognize certain patterns and use such recognition to read the Market. The issue lies in closing our eyes to everything else the Market is showing us, as long as our favorite, easily recognizable pattern is present.

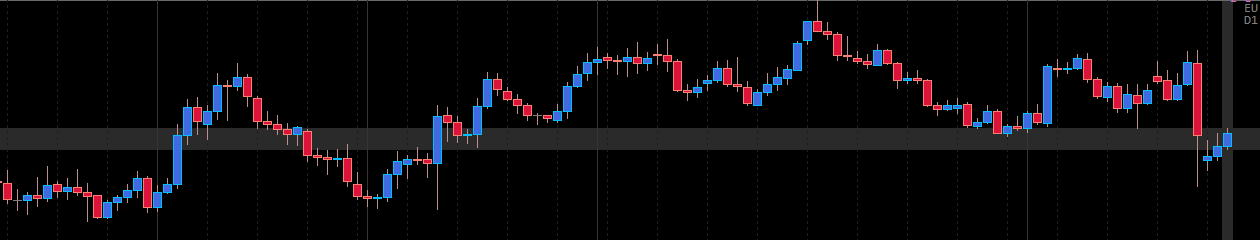

I’ve been watching the markets for more than 11 years now and all this time I’ve been mostly contrarian trader. I would look for opportunities to Sell at exact highs and Buy at exact lows to get great Reward/Risk ratio in these trades. Of course, I realized that the chances of such trades following through are not very high and that such trading opportunities are not provided by the Market often (especially on Daily charts). However, I kept reminding myself of the great return such trades could offer and kept concentrating on them nevertheless.

For many years my main problem was giving up too early. When you start fading a move you have to be ready for a couple failed entries. There is nothing more frustrating than giving up on a trading idea after 2-3 losses and seeing the Market follow through according to your exact scenario – without you. As I studied Price Action and, much more importantly, psychology, I was able to stick with my trading ideas longer and started generating profits out of them, riding some really nice trends. I accepted the reality of the Market – that it can do anything at any given moment – and would be contempt when my idea did not work out.

As I kept on trading and analyzing my successes and failures I started noticing how rarely valid contrarian opportunities (supported by Price Action weakness) were available. Additionally, I noticed how often I would fade the trend, get my small loss (compared to potential profit) and see the trend continue without me for another couple days or even weeks.

For a while I did not even see any problem with that – I just thought of myself as a Contrarian Trader, and was pretty happy with overall results of my trading. However, through constant analysis I could not help but notice how much potential I left on the table by not even considering going with the trend. To me, any time the price is coming to Support or Resistance is a trigger to consider fading such move. Naturally, there are many filters that I developed over the years not to get into obvious traps, but the point is that fading the move is the only possibility I would consider. If I saw that a breakout is likely I would just forget about that setup and move on.

Adjusting Trading Style

Finally, I started reworking my trading system and adding new setups into my arsenal – with-the-trend setups. After spending a couple weeks going through history I identified valid patterns that I wanted to include into my method. I then proceeded with my trading, now looking for these trend setups as well. I thought that because I defined what good with-the-trend entries look like I should be able to jump on a couple soon enough. However, what happened next was quite surprising.

Because of constant work on my mindset and psychology I was not afraid of losses. I also realized that my Trend Setups may not be of very high quality, so I was ready to rework them as necessary, after analyzing a couple live Trend entries. I simply did not see where the problem might come from as I was ready for anything, except… In the next couple weeks of trading I did not find a SINGLE trading opportunity with the Trend! I kept taking my contrarian entries pretty actively, with about the usual degree of success, so I still saw patterns and took trades. But for some reason I just could not find any Trend entries whatsoever – at least not live.

Naturally, I kept analyzing my performance, taking notes about each live entry. I then saw that almost every time I was analyzing a failed contrarian entry where the price was breaking through and continuing with the prior trend, it looked exactly like one of my Trend setup pictures that I prepared. After seeing quite a couple of these extremely clear (in hindsight) Trend setups I started wondering, why the heck didn’t I see a single one of them live? I’ve been watching the Price Action on that exact trading pair very actively, trying to find an entry to fade the trend, but I just did not see the opportunity to follow the Trend, even though it was right in front of me and looked exactly like one of the setups I have prepared.

I finally realized that after all the years of trading the markets in my particular style I became completely blind to any other information the Market was trying to tell me. I would see only what I wanted to see and ignore everything else completely.

Psychological Blindness

Mark Douglas is sharing a very interesting example in “Trading in the Zone”, Chapter 10 (p. 179), where he decided that he wanted to start running. Initially he met extreme resistance just getting out of his apartment and starting running until finally, after great effort and struggle, he “became a runner”. He started thinking of himself as a runner, seeing himself as the runner. Running was something he was not just doing now, it was something that was very natural for him to do. There was no more mental resistance whenever we wanted to run.

Just like Mark Douglas has become a runner, I have become a “Contrarian Trader”. It was not easy, and I struggled for years to be able to fade the trend comfortably, but at some point most of the resistance just went away – fading the trend was something that was very natural for me to do as a Contrarian Trader. Trading with the Trend on the other hand, wasn’t.

Through many years of hard work I have developed a trading style that was easy for me to follow. However, now that I realized the limitations of trading in only this style, I wanted adjust it. I did not want to become purely Trend Trader, but I wanted to develop a more universal approach, allowing me to look for opportunities during the rejection of Support/Resistance but also when the price is already trending from one S/R zone to another.

Unfortunately, recognizing the need for a change, even recognizing what exact change we want to achieve, is not enough to achieve it. Now that I defined a new mental picture of how I wanted to trade I knew what kind of mindset I wanted to develop in order to become proficient trading the new Trend setups in addition to my Contrarian setups. Implementing such a change of mindset turned out to be a pretty complex task.

After some additional mental work I started seeing Trend setups, but the resistance to act upon them was still great. My brain would quickly find one hundred reasons why I should NOT take a particular Trend setup, no matter how good it looked originally. After recognizing the hesitation problem I started pulling the trigger on more and more Trend setups (almost forcing the decision sometimes).

Next issue was holding the Trend trades. While I would be able to fade a trend and ride the trade in the new direction for weeks, comfortably sitting through heavy draw downs in my floating profit, I did not have any confidence in riding the trend if the trade was initiated with one of my Trend setups. Any time the trend would show some kind of correction, I would see a Contrarian entry possibility. Even though many of such possibilities would be filtered out and I would not establish a position to fade the trend, just seeing one contrarian pattern was enough for me to close my with-the-trend entry.

Trading Mindset

The experience I went through showed once again that having a good Trading Method is not even 50% of our success. In addition to having the edge in Market Analysis and finding good Entry Setups, one needs to develop a proper Mindset that will allow him to trade such method without any resistance. Most traders consider that Trading Psychology is about hesitating pulling the trigger, or worrying too much about an open position. My experience shows that sometimes our brain can simply block out all information that it is not comfortable with. If our Mindset is not developed to work with our Trading Method, we can be assured that the brain will find most elaborate tricks to ruin all chances of our success.

We may believe that trading as about Market Analysis. We may believe it is about being right and knowing what the Market will do next. Some believe it is about statistics (and there is some truth to that, in my opinion). But in the end, trading the Market is about people.

People make decisions and these decisions move the price. People are extremely susceptible to mistakes. People, in general, have huge ego that is telling them what to do. Studying Human Psychology can help us to understand people better. We don’t need to have a masters degree in psychology to trade, but we need to be self-aware and willing to analyze our every thought, decision, action. We also need to be willing to empathize with other traders – be it small speculators (like most of us), large commercial traders, non-commercial businesses that just want to hedge their risks or huge multinational banks that really have the capacity to move the market. They all have their own goals, desires, biases, emotions. They all make mistakes. Understanding this, not only we can be more open to searching for our own mistakes but also we will understand the psychology of other traders and will be able to profit from the mistakes they make as well.

Recommended reading: Emotionally Intelligent Investor by Ravee Mehta