There is always something interesting going on in the Market. Different events will make different traders feel differently. Our job is to read their emotions and feelings the best we can and find out where the crowd will be trapped.

Category: Daily Picture

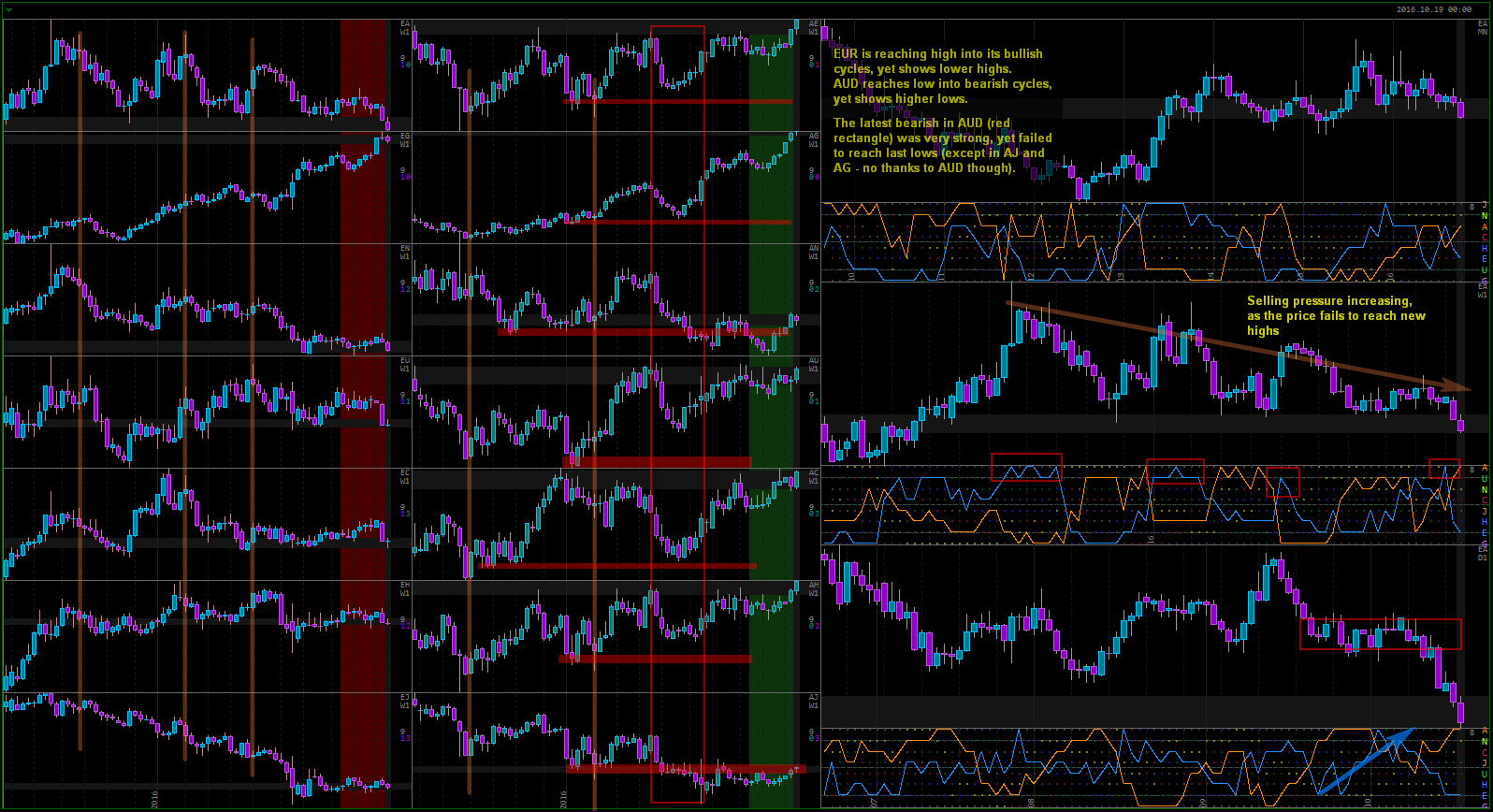

EURAUD update

Trading is much easier in hindsight! I completely misinterpreted the strong bearish support in EA in my last analysis. Let’s take a fresh look:

My contrarian tendencies can be a real burden sometimes, as I fail to see potential breakouts 9 times out of 10. Definitely something to work on.

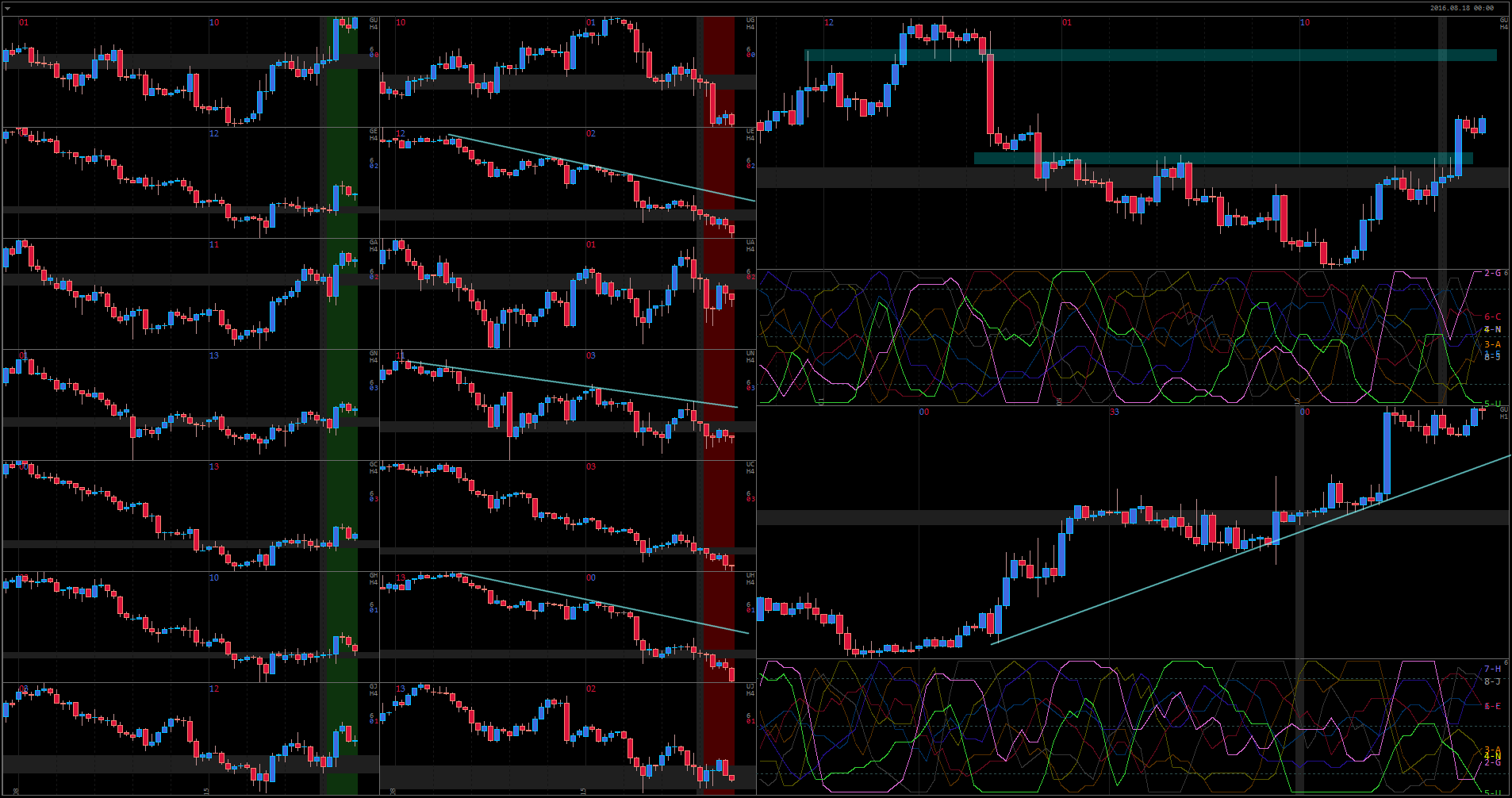

August 18th – GU

GBP is possibly starting a Daily reversal. It’s been oversold for way too long and no one wants to sell further at these prices. However, right now it is finishing its bullish cycle on H4. I want to see the price action in the coming bearish cycle, and if bears will show weakness, GBP will be probably the best currency to buy at the moment.

USD is the strongest bearish currency today, but it does not look just as convincing. There is definitely pressure building up, as many pairs face significant support. However, it is finishing its bearish cycle on Daily (with relatively weak bearish price action) and also on H4. UN and UJ look like great trading pairs to buy for the mid term.

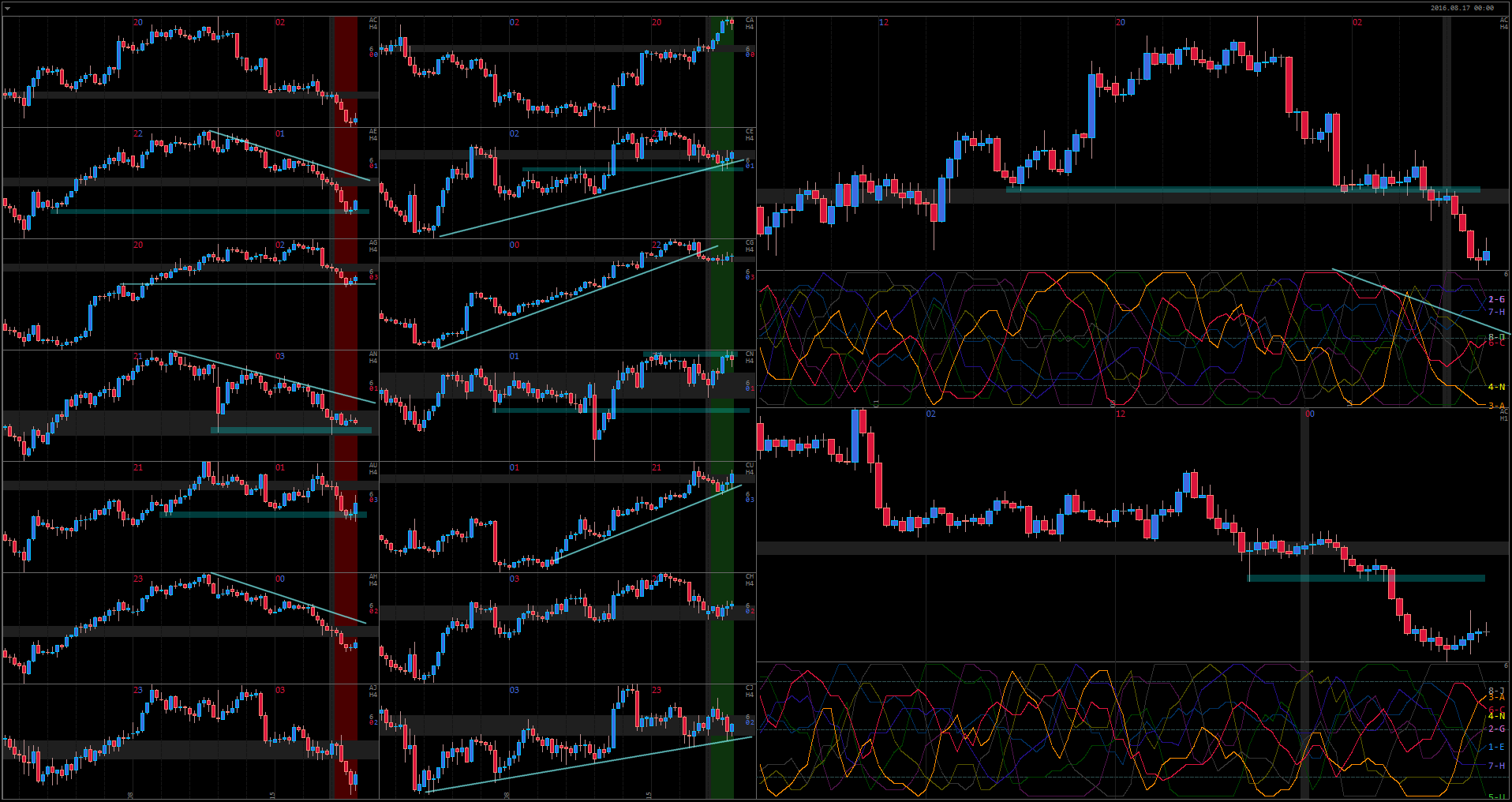

August 17th – AC

CAD is clearly losing its bullish momentum. It is the strogest bullish currency today, but it is unable to make new highs, facing strong resistance in many pairs. There are still many TLs in CAD profile that needs to be broken before the trend reversal is confirmed, but CN is already offering a great selling price.

AUD is the strongest bullish pair today and it is still going strong. The price is correcting on H1 right now, but bullish price action is quite week in most pairs. However, AU and AN look like renewing the highs – all bearish attempts have been rejected in the last 2 weeks.

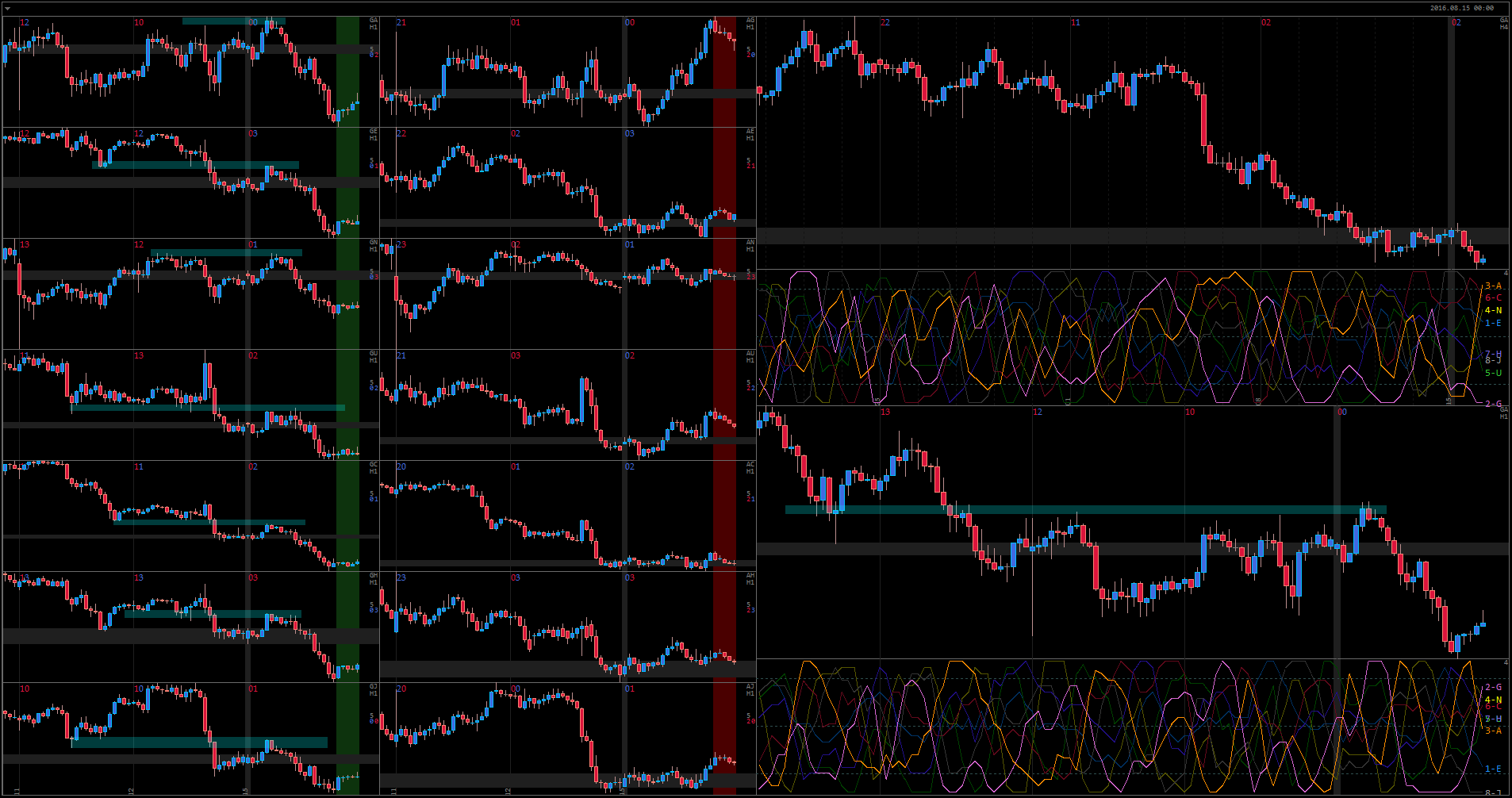

GA

GBP has started the day rising, but it was facing many resistance areas from the previous week, breaking which would have been too much to ask for.

AUD did not really grow today, if we look at other trading pairs. Other than AG, only AU was more or less bullish. AUD is very likely to continue its Daily bearish cycle.

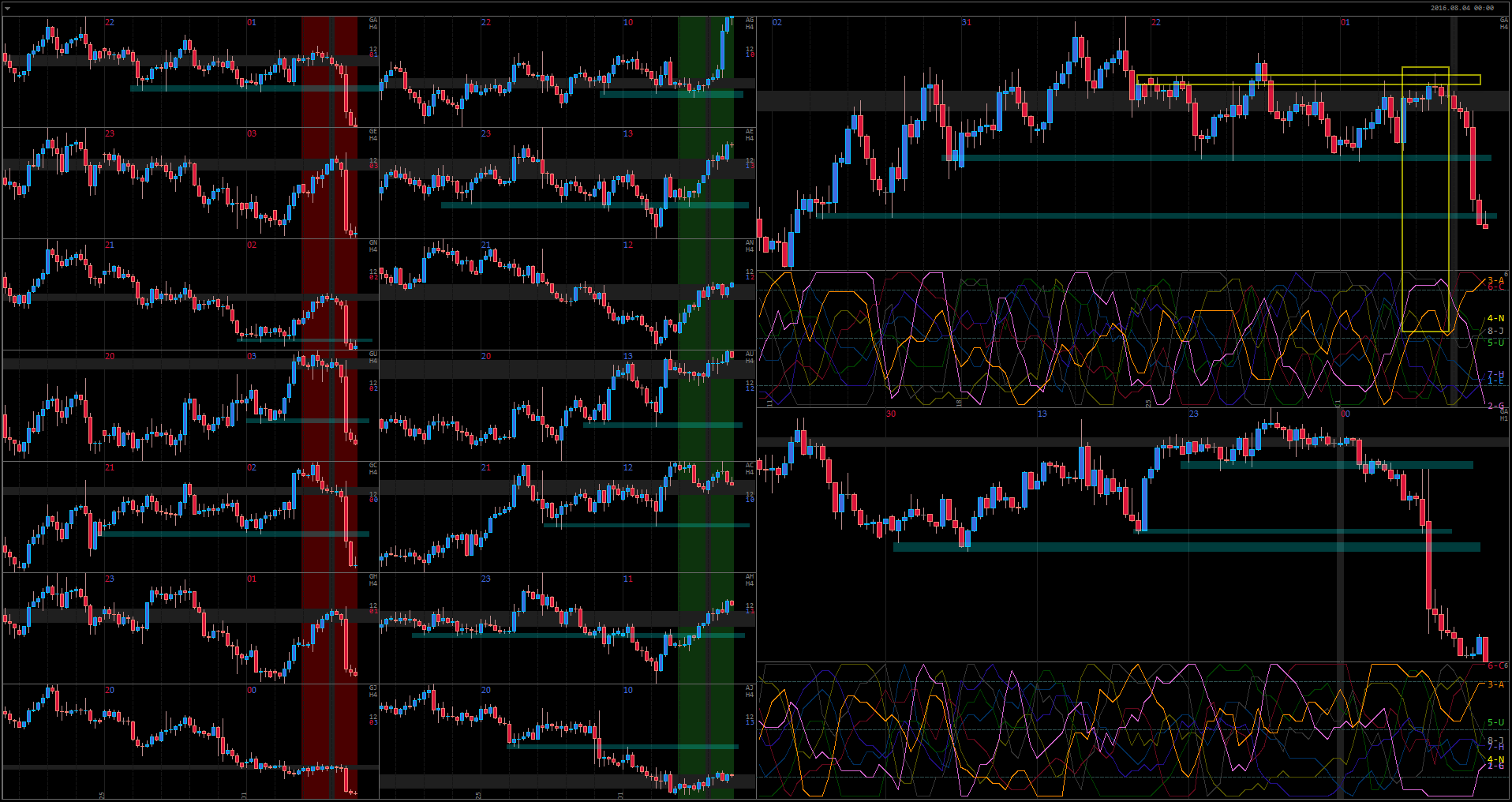

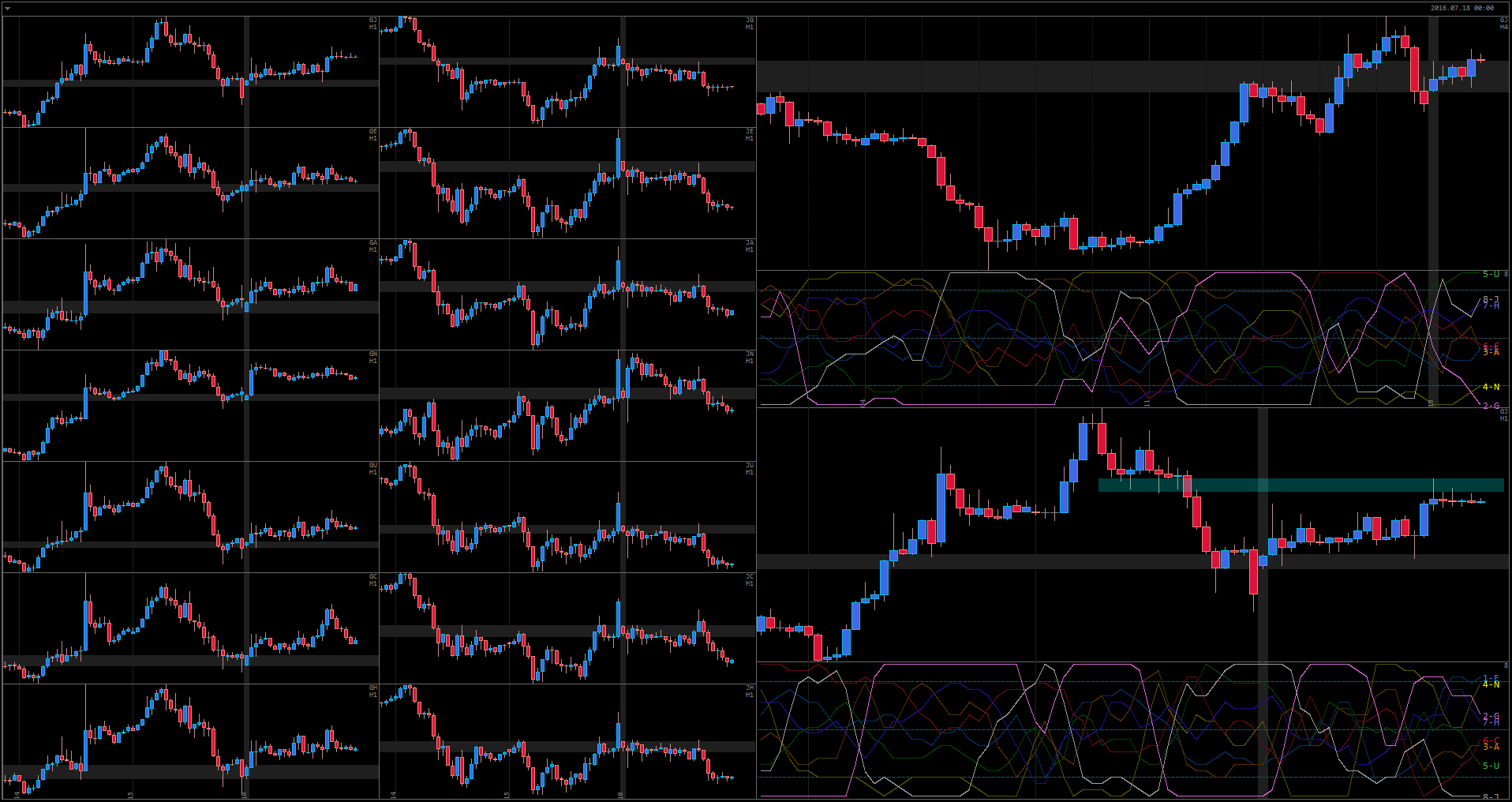

GA – BOE rate cut

A strong bearish move in GBP due to the rate cut today. It will be interesting to watch if GBP sustains this move, since it is meeting support areas in some pairs (GE, GN, GU, GH).

AUD was the strongest bullish currency of the day, but most AUD pairs have struggled to push higher (AU, AC, AN, AJ). AC and AU offer good selling prices.

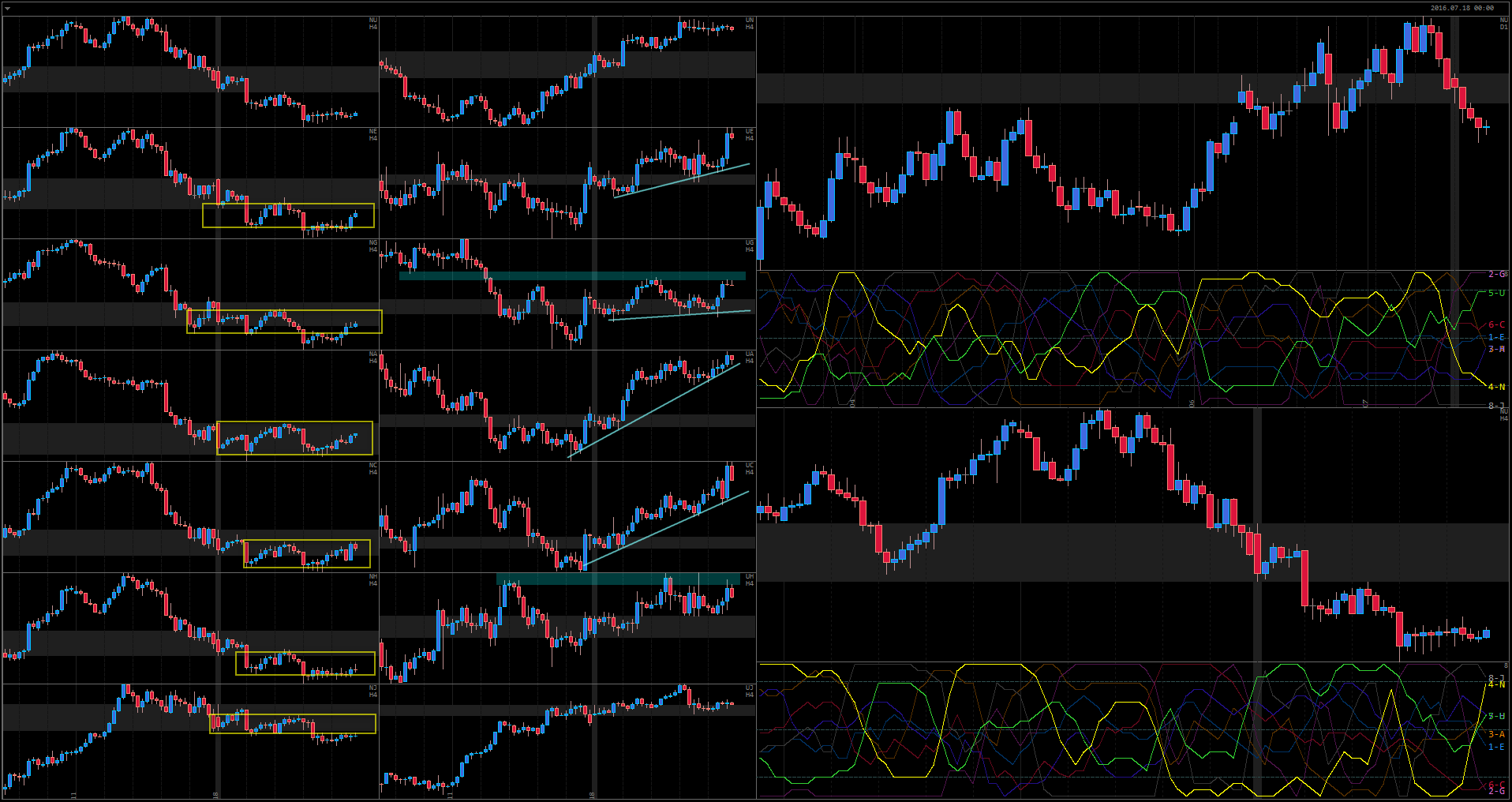

NC – Sharp Rejection

NU – Weakening Move

Despite the fact that NU is the strongest pair of the last week, it’s been really struggling in its descend.

NZD is mostly flat on basically all pairs other than NU.

USD has been growing during the past week, but it really struggled in all pairs other than the commodity group. UH is looking especially interesting, with its 3 consecutive failures to break the high of the last week.

Here is the strongest pair of the day for Monday:

CJ made a determined move today, but only on the smaller scale. If we look at it on higher TFs, we can clearly see that today’s bearish move is just a part of quite a weak bearish cycle on H4. Compare the momentum to the previous bullish cycle.

JPY does not look like it will be growing much longer. BOJ is meeting Thursday-Friday and they are expected to introduce new easing measures. Interestingly enough, the Market is not pricing these planned measures at all, and the price in all JPY pairs are growing towards significant resistance.

JN looks like an interesting trading pair on higher TFs.

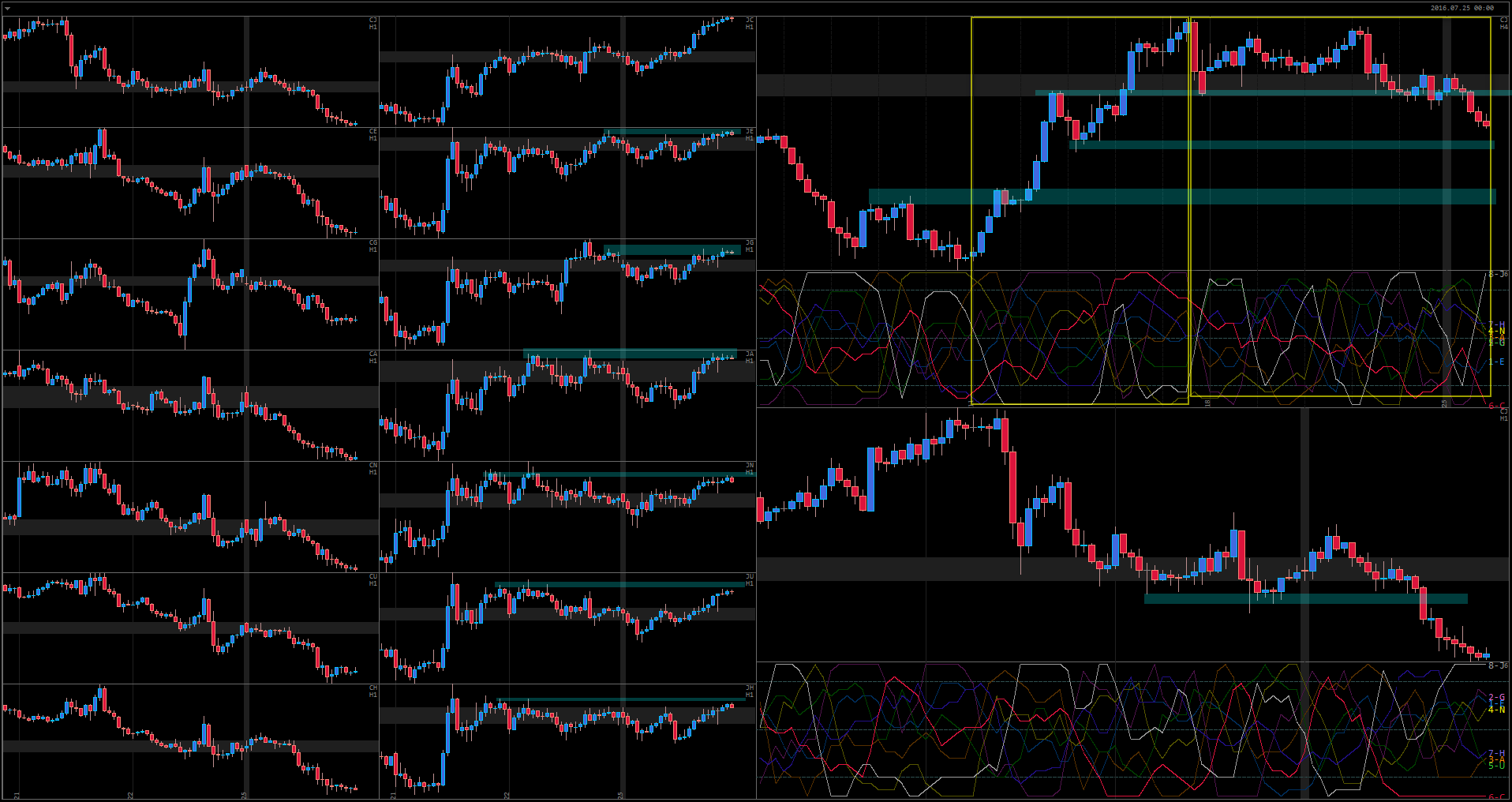

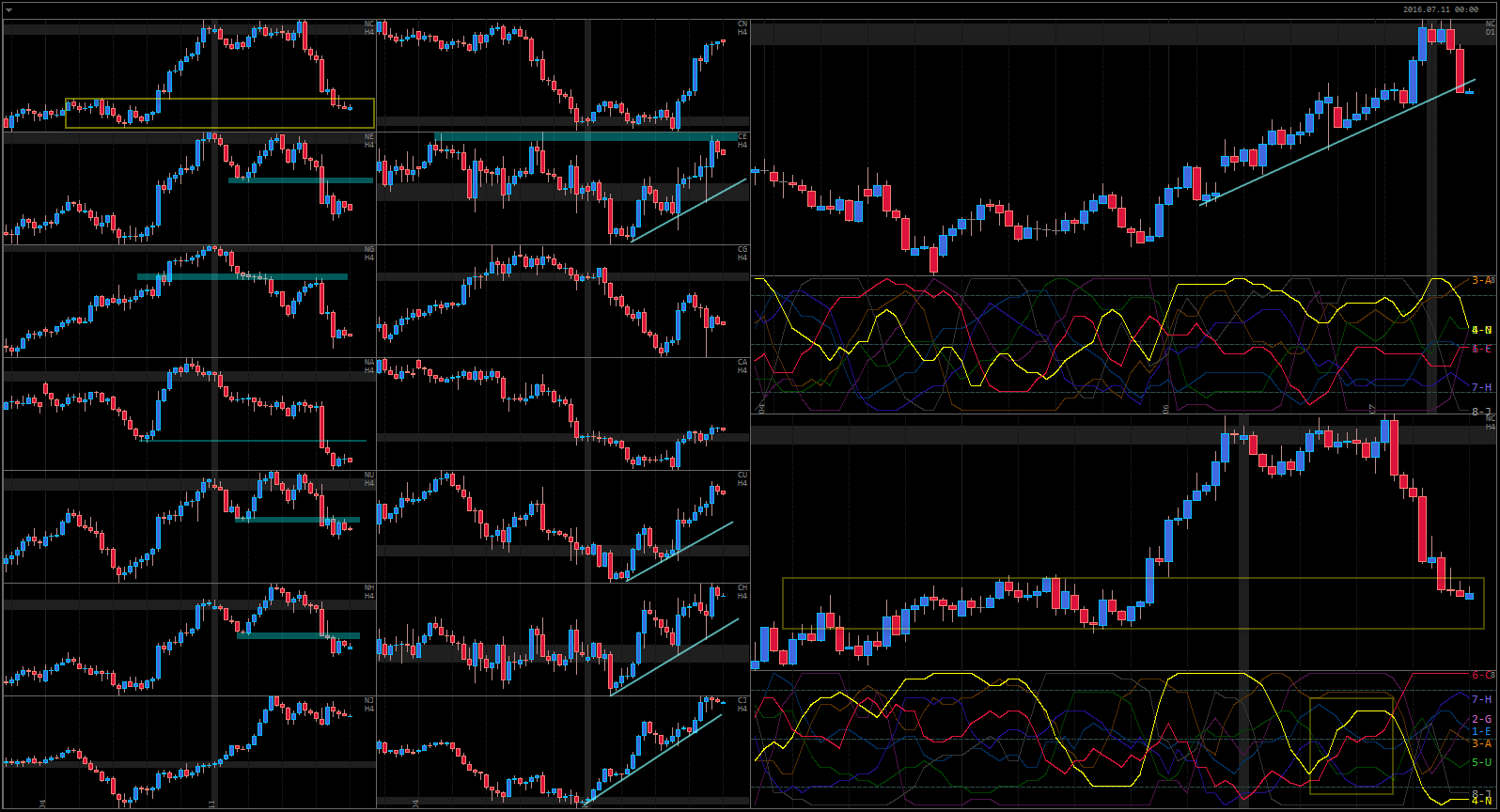

GJ – Weak correction after a strong week

A very weak and conflicted price action today. Not a single currency managed to dominate, but GBP and JPY are the two strongest in the end.

After a strong bullish week on GJ, clearly visible on H4, it closed with a strong bearish day on Friday. The worst possible scenario for bulls is to see price action in their direction, but showing clear signs of struggle. Bulls did manage to raise the price by the end of the day, but given that this is the strongest move on the Market today, and comparing it with the prior bearish move on Friday, it looks like the bears are far from done in this pair.

The Market is already offering good selling price right now, it will be very interesting to watch how the traders bet their money tomorrow.

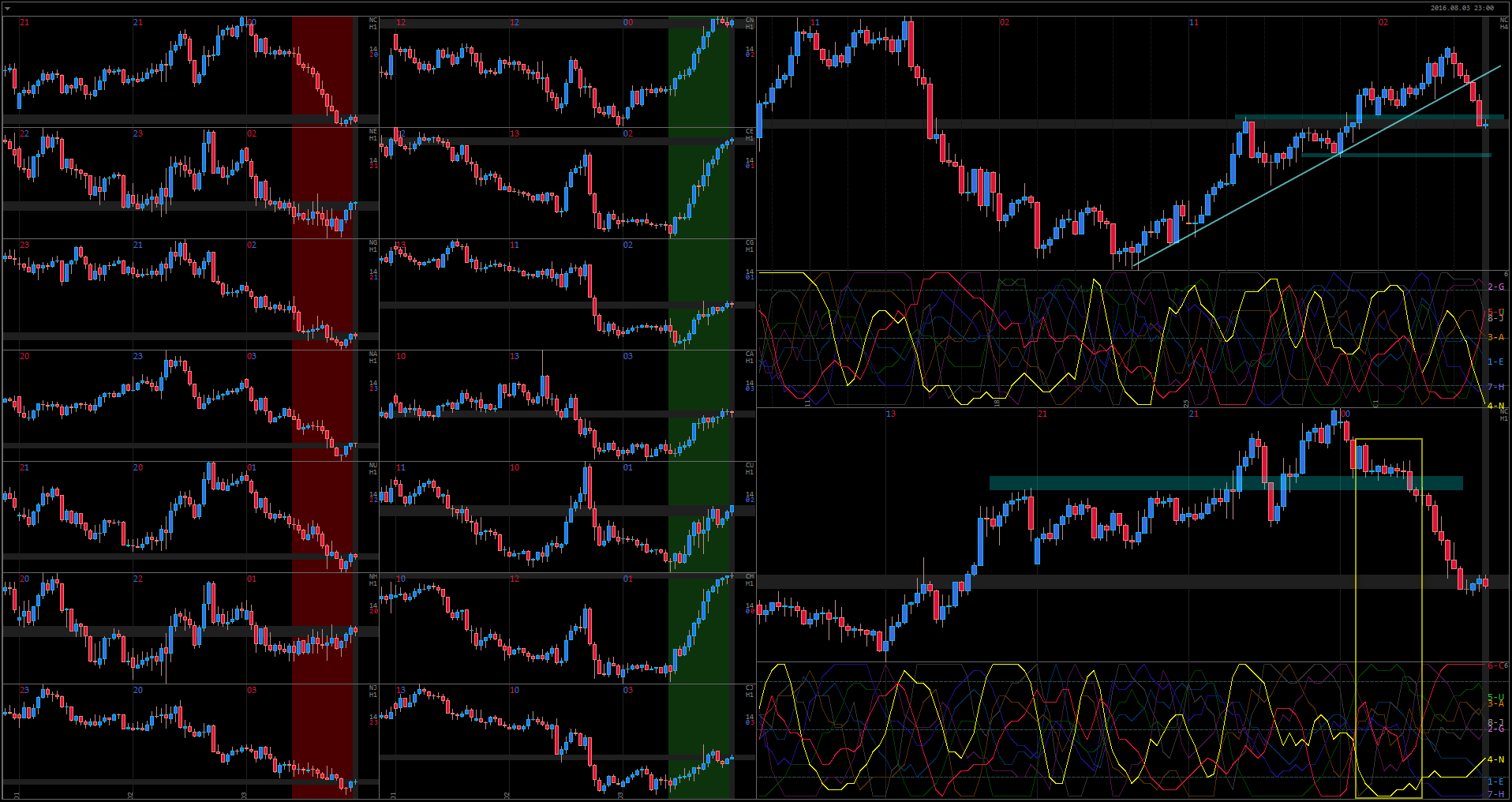

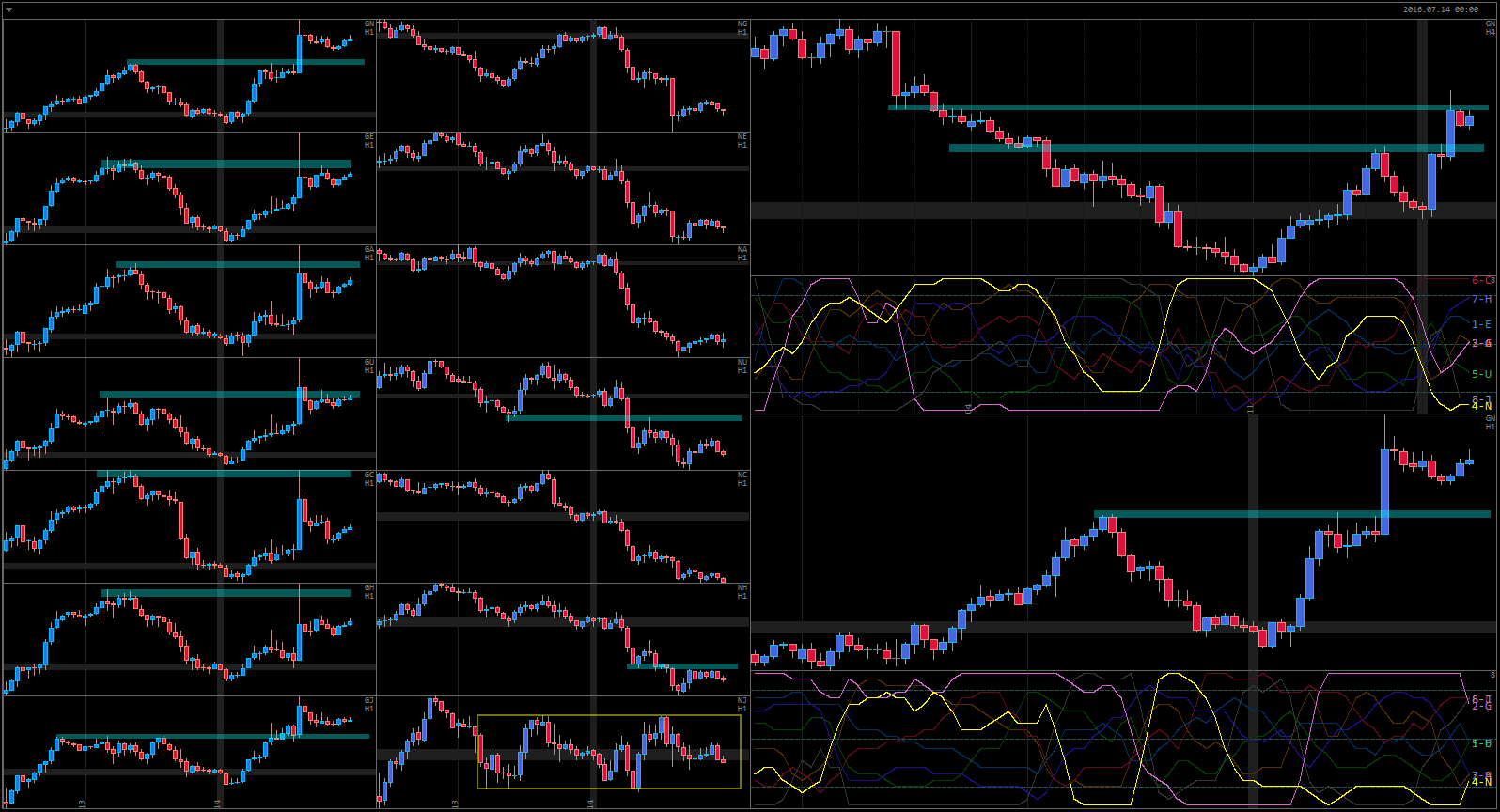

GN – Strong continuation, NC – Possible daily reversal

After showing strong bearish move yesterday, today GBP completely reversed and put up a bullish move. Interestingly, half of this move happened in the very early hours, before BOE kept the interest rate unchanged. No matter how much fear mongering media will create, at some point there will not be any trader willing to sell GBP this low. It will be interesting to see if it creates a significant bullish cycle on Daily-Weekly.

NZD has been the most bullish currency in the past couple weeks and now it also starts correcting – possible even reversing. RBNZ will be meeting on 10th of August and unless NZD depreciates by then there is a very good chance of a rate cut. The Market would normally price upcoming change before hand, so we might see a bearish cycle on NZD for the next 3 weeks.

Together, GBN and NZD represent two of the most interesting currencies at the moment, because they have been leading the whole market (together with JPY) recently.

NZD is also interesting because together with CAD it represents the strongest bearish move this week so far:

The bullish move created by NC at the end of the last week is completely cancelled now. The price is approaching Daily TL.

Looking at NZD profile on H4, many pairs have broken below their recent swing lows.

Looking at CAD, the bullish move this week is very well sustained so far (with exception being CG). However, CAD is slowing down and is very likely to correct in the last couple days, before it can continue higher. Supply is coming at these higher prices virtually on all CAD trading pairs.