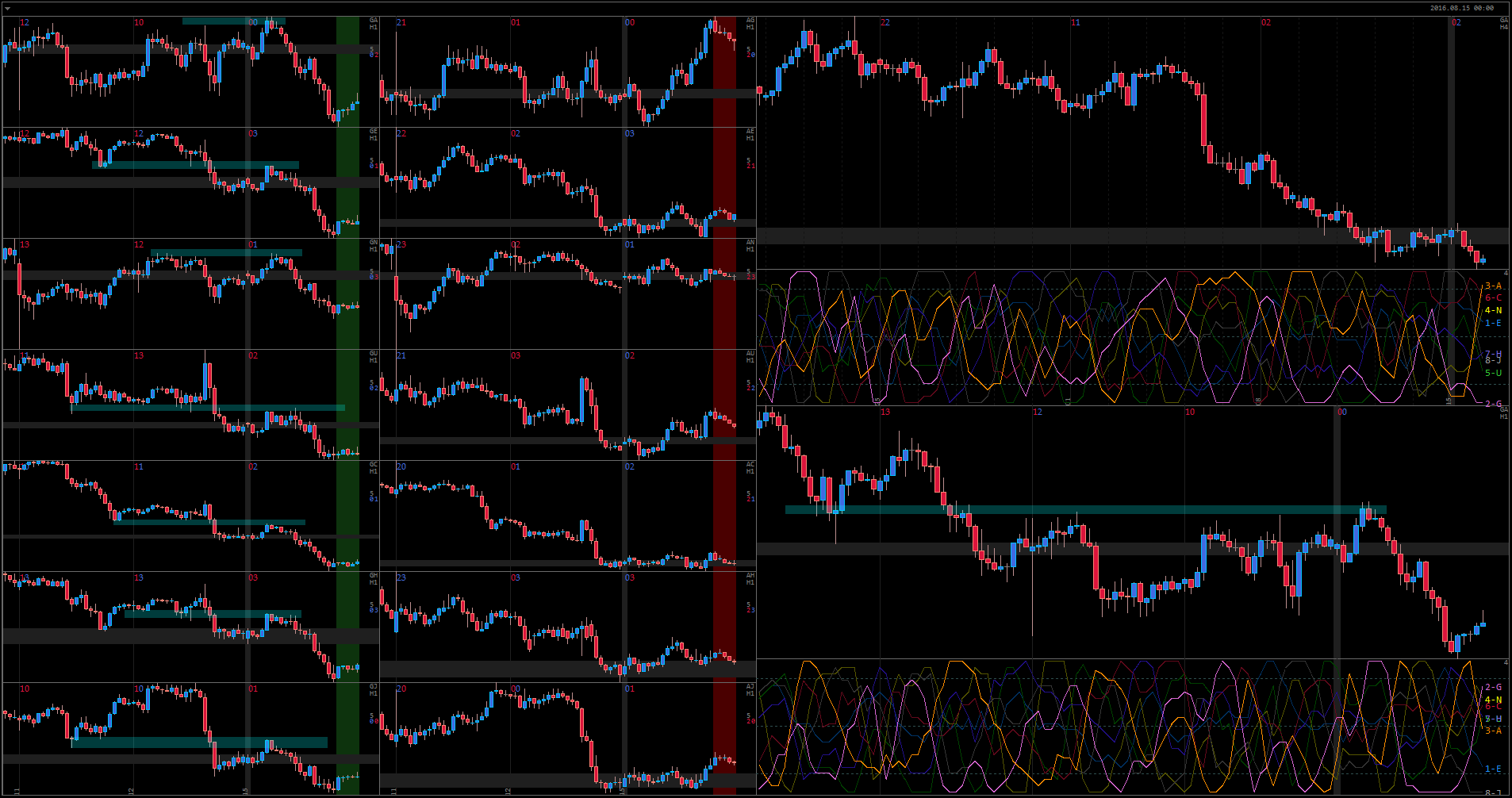

Despite all the doom and gloom that most analytics suggest for USD, price action suggests otherwise. To me it is always important to compare economic events with traders’ psychology I am reading on the charts.

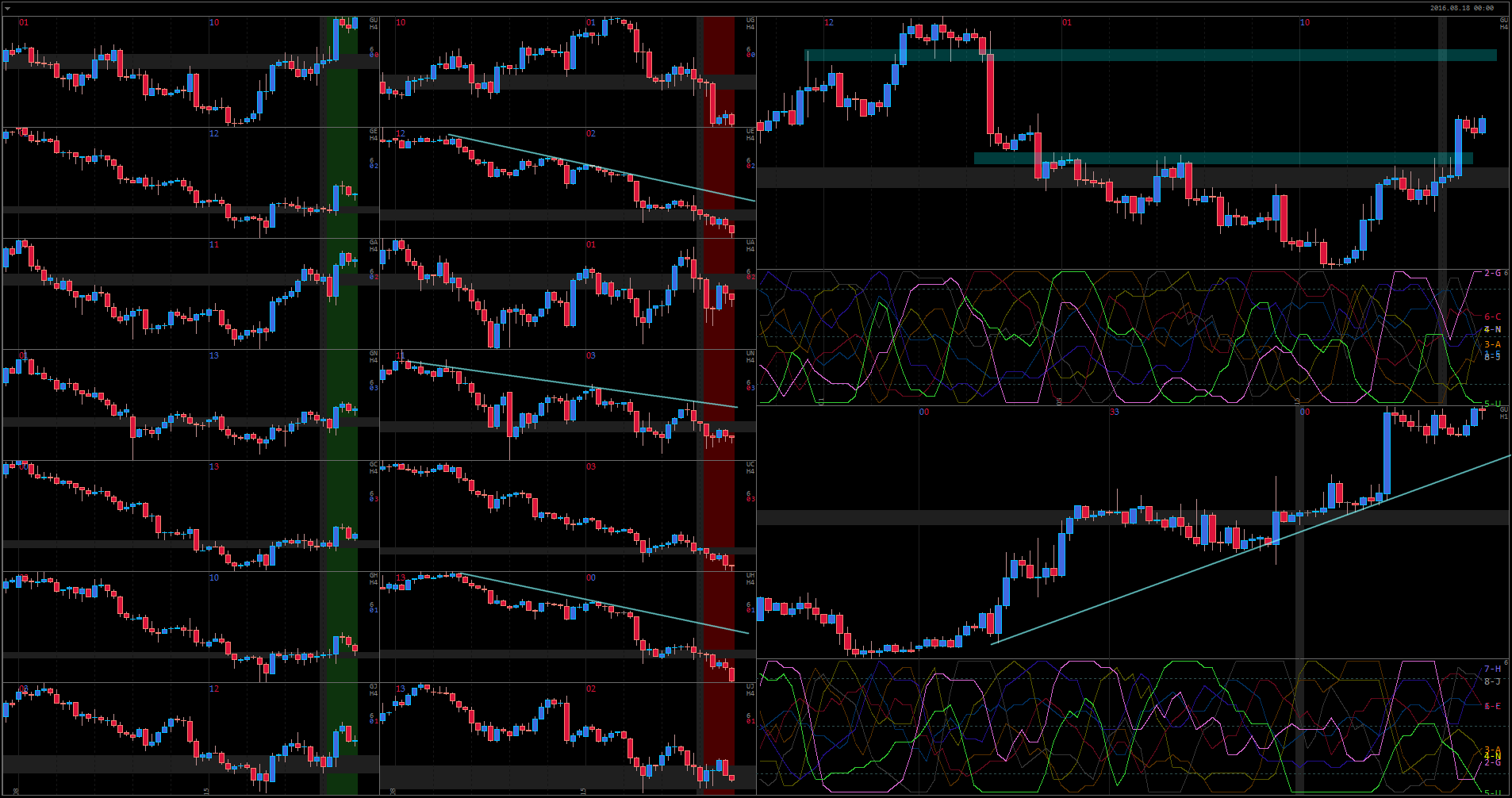

USD has been trading in bearish cycle on Monthly for almost 2 years now. USD is the most bearish currency in that time frame, right after GBP. Additionally, COT reports has been showing increasingly negative sentiment for USD (which did recover in the past months). Fundamental releases were pretty negative for USD as well, and US economy is far from doing well. FED is unable to hike rates even by another 0.25%. So where is a huge USD trend reversal?

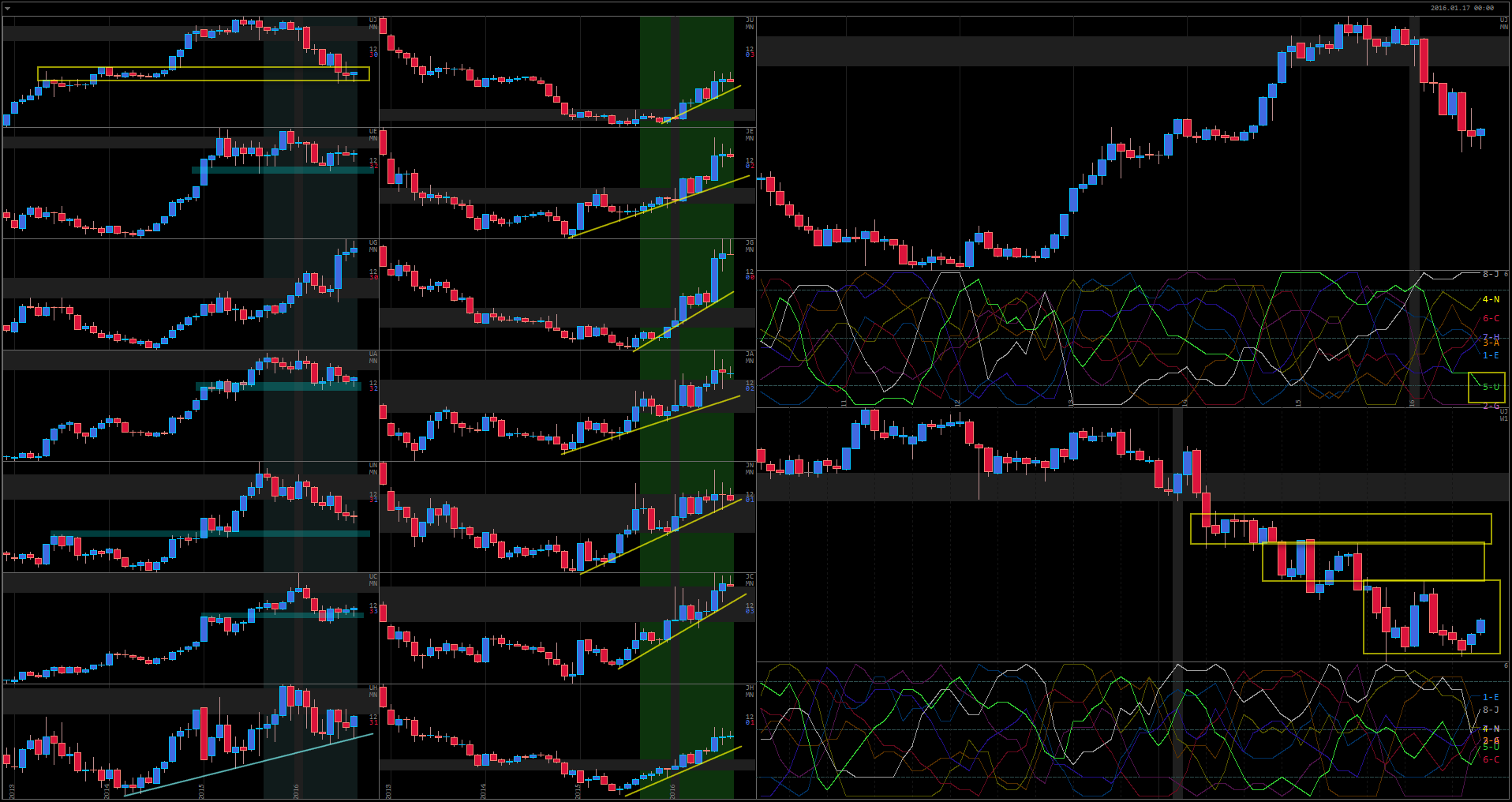

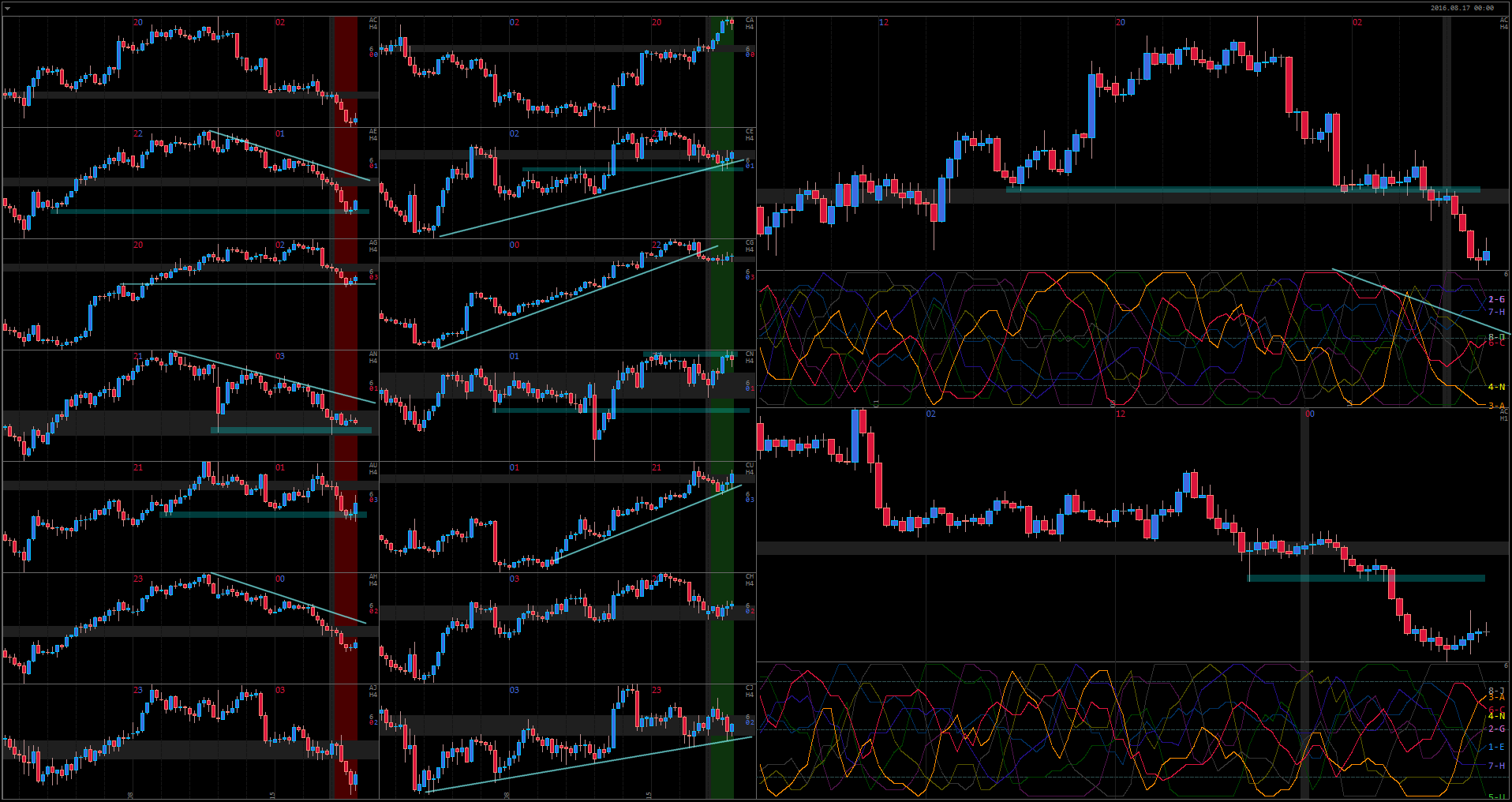

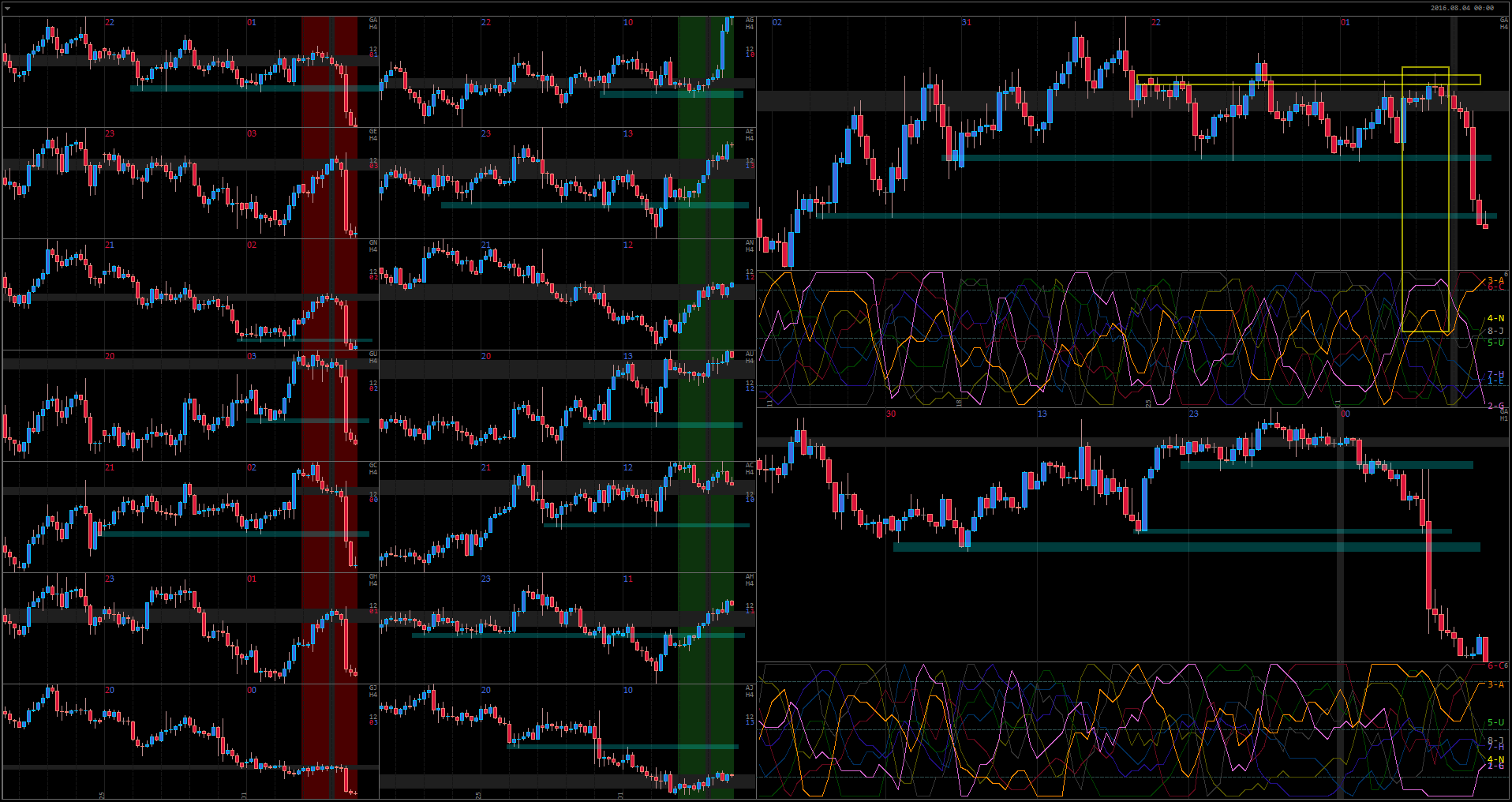

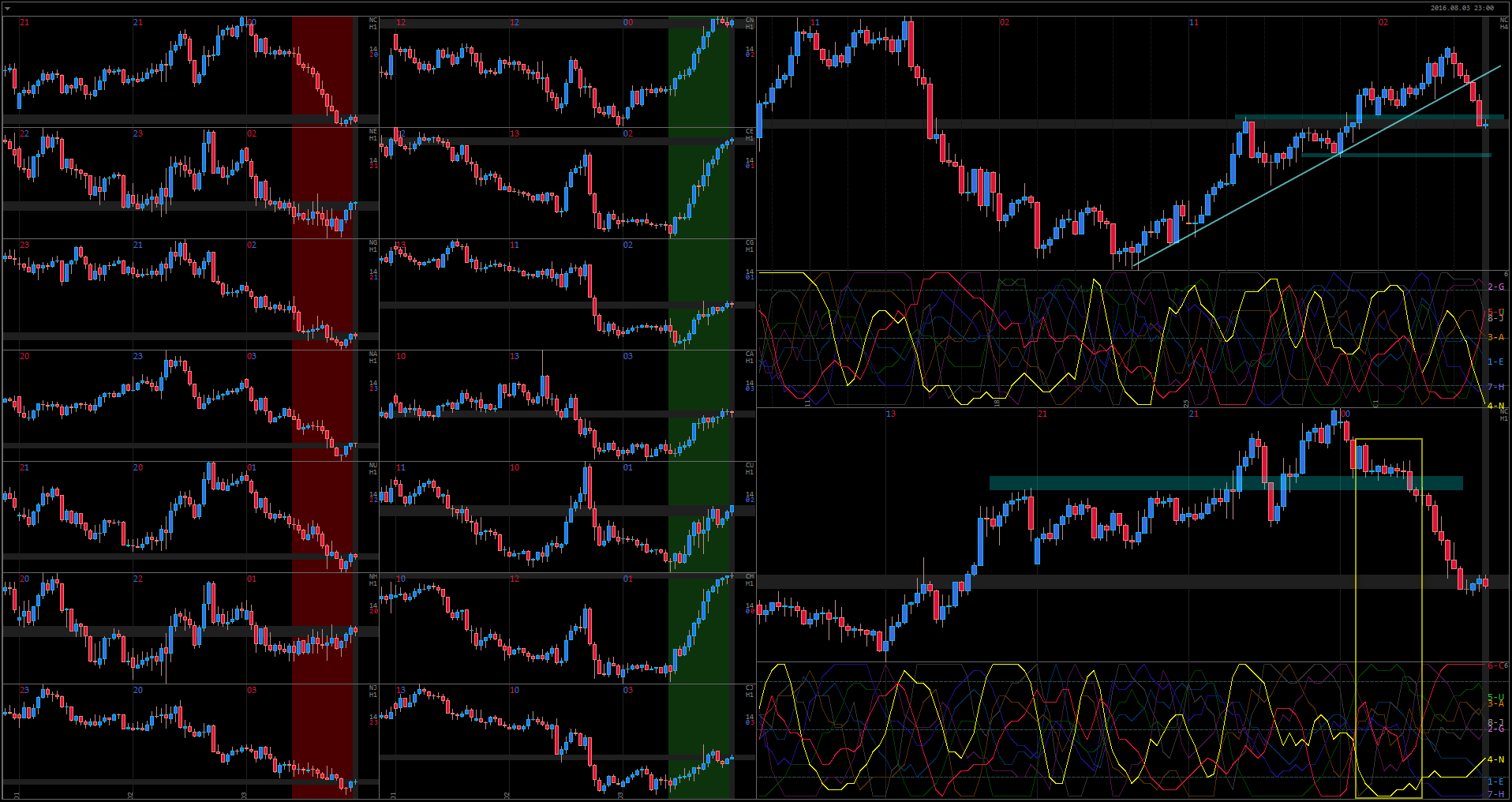

The only significant bearish move between all USD pairs was seen in UJ. If we look at the USD profile overall, it has barely corrected to its strong bullish trend. Not only that, but it is approaching strong support areas right now. If bears were not able to show significant bearish cycle when everything was going against USD, I am fully expecting the coming bullish cycle to be strong.

Of course, a reversal of Monthly price action will take time, so we are planning the next 6-12 months here. USD might go lower for a while, but it doesn’t look like the Market is accepting it at these prices very well.

Looking at JPY, which was undoubtedly the strongest currency during he last 2 years, it is also approaching a point where traders are not willing to pay this much for it. UJ in particular is trading in a very important Monthly support area, as seen on the chart. With such expensive Yen, Japanese government is in trouble. They’ve been trying to stop the trend, quite unsuccessfully during the last 6-12 months. However, right now we are at a point where speculators are finally going to help BOJ and start selling JPY.

As usual, it is crucial to watch price action in real time, to adjust our plan as necessary.