Quoting Scotiabank:

AUD positioning is a little more perplexing; the modest net long in the market that has persisted since mid-year has turned into a large and relatively significant net short. Week on week, this is the largest positioning shift against the AUD since the carry trade rout of 2007. There is little obvious fundamental news to have driven such a turn in sentiment over the past week, in our opinion.

This drop in Net position is certainly interesting, especially in light of recent strong Bullish action on AUD.

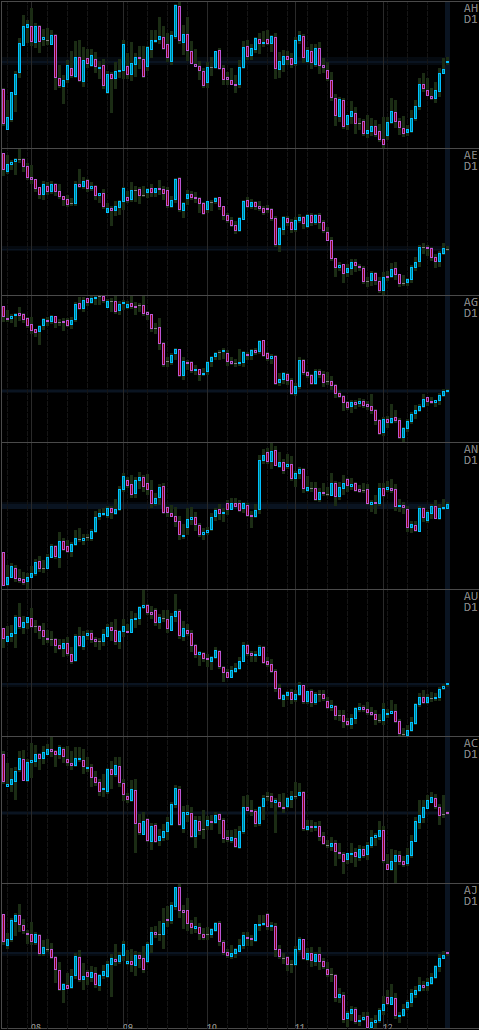

Looking at all major AUD pairs the Bullish cycle is very clear against all other currencies, but also interesting is the fact that price is trading near important resistance areas right now on many pairs:

Given the size of this positioning shift, it does not seem likely to be caused only by profit taking before Christmas. What do these large traders know that we don’t? AUD pairs certainly deserve some serious attention in the coming week.

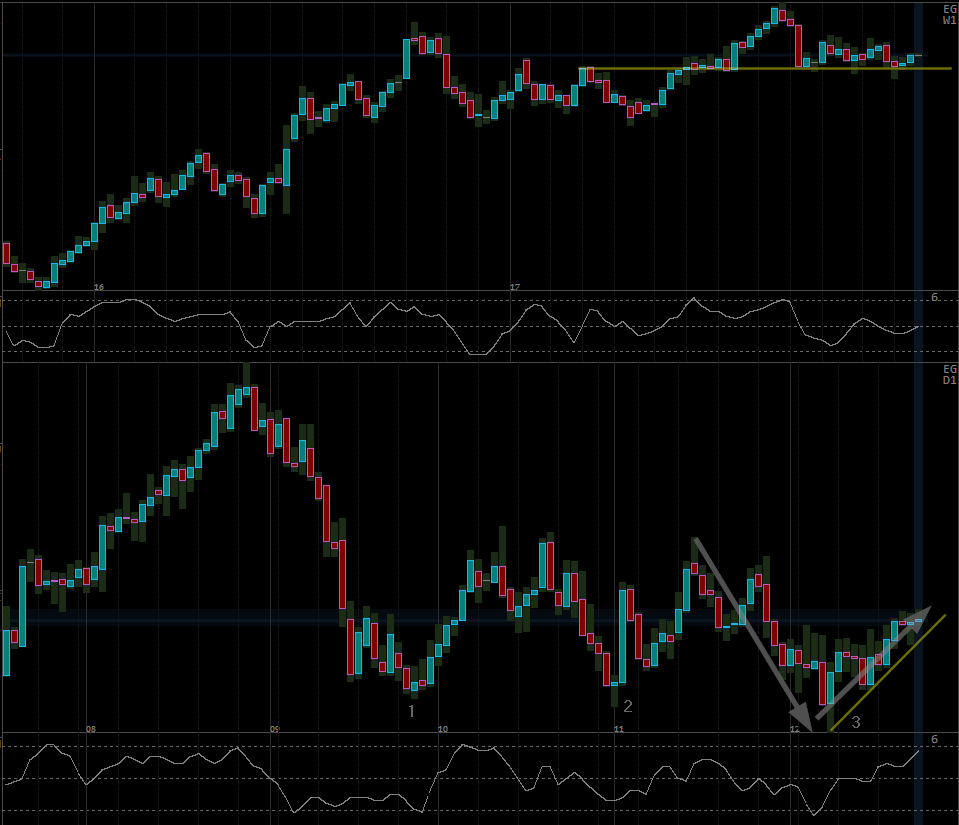

Here price is approaching a long term value zone on Daily. As it climbs higher I am looking for any signs of weakness that would signal a Sell trade.

Price has been trying to break below this level on multiple occasions, each time reaching a little bit lower. Comparing momentum between Bullish and Bearish swings, Bears have been stronger throughout the whole range for the past 3-4 months. Current Bullish swing is slowly climbing towards the higher range boundary. This is definitely a Selling opportunity.

Complex Bearish correction in a Bullish trend. Looking for price rejection, ideally as it breaks the nearest support on H4.

Price is breaking above long term range with some strength. I am still skeptical about long term Bullish continuation, but only because price seems to be too expensive to be a buyer. Watching for possible rejection.

Even though trendline has been broken, another test remains just ahead to confirm change of trend. Given signs of weakness as price approaches this level, rejection and a Selling opportunity is the main scenario.